Analyzing Cryptocurrencies As Capital

Alireza BARIKLOU 1*, Seyed Hadi ARABI 2, Mohammad Amin REZAZADEH 3

1 Professor, Private Law department, Law faculty, Farabi college of University of Tehran, Tehran, Iran.

2 Associate professor, University of Qom, Qom, Iran.

3 PhD student, Private Law, Aras International Campus of University of Tehran, Tehran, Iran.

ABSTRACT

The emergence and prevalence of cryptocurrencies guided the states towards various approaches and the issue has been more investigated from the perspective of money and monetary regulations; while, the current article has explored cryptocurrencies from the perspective of digital capital and it was proved that the coercive and hostile approach or opposition does not have any effect on circulation of cryptocurrencies and their denial. Thus, cryptocurrencies can be managed by considering them as valuable capital in the financial markets. It was also proved that the absorption of cryptocurrencies being supported by the Islamic financial regulations does not contradict the canon, and Iran’s statutory provisions have the capacity of providing the conditions and legal solutions for absorbing cryptocurrencies as capital. This article has been conducted based on a descriptive-analytic research method, and cryptocurrencies and the countries’ approaches towards them were seminally explicated followed by analyzing and justifying the legitimacy and conditions and legal solutions of absorbing them as capital in adherence to the Islamic financial regulations and capital rules.

Keywords: cryptocurrencies, capital, legal solutions, legitimacy, smart contract.

INTRODUCTION

Considering the fact that the development in modern technologies results in the occurrence of new subjects daily, on the one hand, and since the economy has become increasingly important in the lives of the states and communities and the counties need to create grounds and provide legal, economic and, even, political security and develop the software and hardware infrastructures of investment for creating dynamic relationships, corroboration of the economic and business exchanges with the foreign parties and, even, domestically especially for absorbing capital and developing their economies on the other hand, it is necessary to enact the required regulations and rules for using modern technology and novel instruments of capital intake for booming the employment and developing the economy.

Therefore, the country’s absorption of and equipment with the resources and capitals, particularly, the absorption of the foreign capital without which no country’s development is feasible and supply of the resources through the proper ways entail the creation of new legal mechanisms. The most important principles in the area of capital absorption are “ownership protection”, “capital turnover” and “capital risk” as well as such other axioms as “prohibition of risky transaction”, “denial of loss”, “prohibition of improper accumulation of properties”, “prohibition of usury”, and “prohibition of trick for evading the verdicts”.

In this article, the digital currency absorption is investigated as an intangible capital and asset because there are usually entrepreneurs who lack the adequate capital but possess the required technological knowledge and experience and there are also individuals possessing the capital but not knowing what to do with it and/or not having enough time and vigor to make investments. The individuals from the first group usually apply the small and large capitals and money amounts held by the others under the title of publicly held companies to achieve economic prosperity and create jobs and, because the diverse financial instruments are consistent with more individuals’ tastes and goals, more resources and investors are accordingly asked and absorbed to participate. Therefore, the innovation of the new instruments of investment leads to the creation of generative employment. In line with this, the new technologies, particularly, the science of cryptography and network computing cause of the creation of essential changes in the realm of capital and investment and the newly emerging phenomenon as encrypted money can be pointed out amongst the most important of these evolutions. In fact, the encrypted money (cryptocurrency) is a private system for the facilitation of the inter-individual exchanges without any need for the presence in the central and intermediary institutions. Cryptocurrencies and their related technologies like blockchain systems are rapidly becoming pervasive. So, the required legal solutions and capacities should be provided in line with the application of the new instruments and technologies in the light of the preset goals.

Thus, the present article investigates the digital and virtual currency as a newly emerging capital as well as the legal conditions of its absorption and also the solutions for their utilization in adherence to the regulations of the Islamic law. The article’s assumption is that the value concept should be essentially taken into consideration by the experts, specialists, and decision-makers in the developed economic activities similar to such concepts as cryptocurrency or like and pay-attention that are currently playing roles in lieu of money as a value and being envisioned as digital assets considering the fact that a considerable amount of the financial exchanges are carried out using cryptocurrency through systems outside the supervision of the current banking and financing systems. In this article, digital currency, countries’ approaches to it, its qualification for being viewed as capital and asset and the legal absorption solutions have been investigated.

In the primitive human communities, family needs were limited to the supply of the preliminary necessities and the need for exchange was gradually felt in proportion to the mankind’s progress and the communities’ complexity and barter transactions, “commodity money”, “metal money”, “gold and silver metal money”, “paper money”, “bank-issued money”, “electronic money”, and, for the time being, “encrypted money” have become respectively customary. Digital currency, encrypted currency, encrypted money, coded currency, cryptocurrency, etc. have so far been the latest novel technologies in the area of the financial exchanges that are stored electronically and through the use of encrypting algorithms without the presence and control of the intermediaries (national or international and banking institutions) for assessing the value of the exchangeable items or storing value in the form of goods or for transacting the intellectual assets. A sort of this same asset is produced in the virtual space and used therein (by they are inconvertible). Another type can be transacted with the same property at a given rate for legal currency or even goods. Yet, there is a third type that can be bought by means of real money or converted by the foresaid money types and it can be also used for buying real or virtual (non-centralized) money. Unlike the digital currencies distributed ledger technology that proves the ownership through centralized power of a ledger bank wherein the individuals’ assets are registered, here, every member of the network has a ledger wherein the individuals’ assets are registered and a digital signature with a public and private key is used along with the blockchain to secure the transactions for which hashing algorithms are employed to convert the individuals’ information into 256-bit (64-character) threads so as to ensure the individuals of the confidentiality of their information.

The birthplace of the digital currencies is the substitute system of governmental money payment and a non-centralized encrypted currency independent from the government. In other words, digital currency is a completely P2P, distributed, and customer-oriented currency the value of which is determined by the users and they can be sold and purchased on the software featuring open-code sources and installable on any computer and mobile. The payment systems, generally, and currencies, specifically, are dependent on their values. Value means the extent to which every person is willing to give to a thing such as to items like food or housing that are required on a daily basis by real persons and/or to such a metal as gold that is rare. Value is also pertinent to energy but it has to be defined based on the work performed. Finally, equivalent values are introduced for intangible and invisible cases like experience, knowledge, creativity, and technical knowledge, as well (Davies, 2002). Basic cryptocurrencies are divided into three sets, namely extractable, extracted and mixed, with the latter being a combination of the two, to wit an amount of currency is previously extracted and another part is to be extracted by mining mechanisms. For example, when Ethereum system was about to be launched and before it reaches the full launching stage, it offered an amount of its future currencies in exchange for Bitcoin to the users and developers (Research Center of Islamic Consultative Assembly, 2018).

Islamic Republic of Iran’s Central Bank, as well, issued a document in 2018 under the title of “the requirements and criteria for performing an activity in the area of cryptocurrencies in the country” as the draft of the central bank’s policy deed regarding the cryptocurrencies for informing and inquiring the experts and specialists. Cryptocurrencies are considered as a sort of financial assets that come to existence on a digital, non-centralized and transparent ground named blockchain. These assets can serve the same functions of money under certain circumstances. In this document, cryptocurrencies are categorized into four types.

The first one is the universally accepted cryptocurrency the use and exchange of which is not limited to a given territory and it can be used in internet-based transactions by all the people around the globe. This type of cryptocurrency has become prevalent in two types of asset-backed and asset-unbacked with the latter being extractable by all people; Bitcoin and Ethereum fall in this set. The former is issued by a real or legal person with the support of a tangible or intangible asset, but it cannot be extracted by the general public with its most well-known types being XRP and Tether. The second one is the central bank’s cryptocurrency (CBCC) referring to the electronic form of the money issued by the central bank and being capable of distribution on a ground-based on the encryption principles and exchange in a P2P manner without the involvement of any intermediary institution. This type of cryptocurrency is issued by the support of the country’s national money (RIALS). The third one is regional money which is a cryptocurrency issued and used by the support of an asset agreed upon in a multilateral treaty between several countries with the objective of facilitating and accelerating the business exchanges between those countries. The fourth one is the cryptocurrency resulting from the initial coin offering/Token (ICO). This currency includes the process in which a real or legal person issues digital token or cryptocurrency inside the country and provides the investors with several units of it with such goals as capital supply. This type of cryptocurrency can be issued with or without assets’ support. The issuance and dispersion of this type of cryptocurrencies can be performed by its developers and the central bank is given no role and responsibility in this regard. Amongst the cryptocurrencies, all of the asset-backed examples are the focal points of the present study’s discussions for they can be absorbed and invested as digital capital.

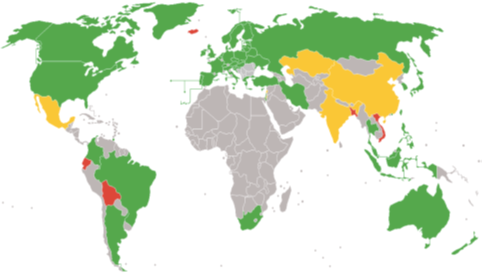

Although countries differently approach digital currency, its circulation is a reality that cannot be either denied or prevented. So, it has to be managed in such a way that its advantages can be put into practical use and its disadvantages can be reduced because, as opined by some, three important factors of offering notable perspectives, reducing the transaction costs by means of online shopping, possibility of remaining more anonymous as compared to the credit cards and non-centralized designing of the digital currencies in line with protection against inflation have added to the popularity of the digital currencies (Moore, 2013). In the following map and table, countries’ approaches towards digital currency have been examined with a green color denoting acceptance, red designating the hostile approaches, yellow indicating opposition, and grey showing the unknown approaches of the countries.

Figure 1: Countries' approach to digital currency

(Source: Tasca, 2015)

Table 1: Bitcoin's legislative status in the world

|

Region/country |

Legislation status |

Source |

|

North America |

Region: legality of Bitcoin US: classification of Bitcoin as a non-centralized virtual currency, commodity and asset and suspending the activity in digital currency on the acquiring of certificate in the near future Canada: as an intangible asset Mexico: announcing legality |

W. Cohan, 2017 |

|

South America |

Bolivia and Ecuador: legality of Bitcoin Brazil, Chile, and Colombia: illegality Argentina: despite illegality, being considered as goods or objects in the civil law |

W. Cohan, 2017 |

|

Middle East and South Asia |

Jordan, Lebanon, and Saudi Arabia: illegality Bangladesh: forbidden Pakistan: under investigation for evading tax India: under legislation |

W. Cohan, 2017 |

|

East Asia |

China: the permissibility of Bitcoin transactions by real persons and impermissibility for the financial companies Japan: introduced as a means of payment and not being considered as a legal currency South Korea: the legal indictment of the illegal activities through Bitcoin Taiwan: sales and purchases in the kiosks Thailand, Indonesia, Vietnam, Philippines, and Singapore: nonexistence of a related law |

W. Cohan, 2017 |

|

Oceania |

Region: no penalty on the use of Bitcoin Australia: exchanged as money New Zealand: not being opposed but as a “value storage” |

W. Cohan, 2017 |

|

EU |

Enactment and existence of no special laws regarding the position of the digital currencies as a monetary means/financial exemptions for transforming traditional currency to Bitcoin/introducing Bitcoin as a digital representative of value and use of it as a substitute of money under special conditions |

W. Cohan, 2017 |

|

Switzerland |

Enforcement of banking and financial regulations in the area of digital currency and identification of Bitcoin by FINMA Institute as a means of payment like foreign currency |

Tasca, 2015 |

|

Russia |

Offering the legal draft version under the title of “digital financial assets” to State Duma of Russia by the order of Putin/issuance of threefold instruction for modifying the digital economy program and smart contracts in 2017 with an emphasis on preserving the position of Ruble |

The center for presidential progress and evolution cooperation (2018) |

|

England |

Offering a report under the title of “distributed ledger technology, beyond blockchain” by England’s Ministry of Treasury and offering a collection of legal recommendations and expressing that “government should consider the creation of a legal framework for distributed ledger technology” and that “the regulations should be evolved in line with the novel developments and implementations and application of technology” |

Kakavand et al., 2017 |

Iranian government, as well, has not yet declared a formal stance in regard of the virtual currency and the supreme council of securities and stock exchange market that is currently responsible for policy-making and determination of the newly emerging instruments based on paragraph 24 of article 1 of the Islamic Republic of Iran’s securities exchange market law, passed in 2005, has not yet announced any position in this regard, and it has just published research about virtual currency. It is stipulated in this paragraph that “securities include any paper or deed type guaranteeing the transferable financial rights for the owner of a specific property or its benefits; the council determined and declares the securities that can be transacted”. The terms “financial instrument” and “securities” have been used interchangeably in the text of this law. In the current research paper, the ideas by the proponents and opponents of virtual currency will be presented and it will be seen that the oppositions are mostly due to the non-reasonableness of the virtual currency and the risky transactions based on it. But, expressing the two reasons for justifying the severe fluctuations in virtual currency prices, the proponents believe that these fluctuations are due to the market’s supply and demand and based on the intellectual reasons, not speculation and, secondly, propose currency assessment based on dollar exchange rate as the main reason and state that such fluctuations will not be seen when the digital currency is used as a reference currency (Securities and stock exchange market organization, 2017).

Moreover, the lack of supervision by the government as the exclusive monetary policy-maker, possibility of the general public’s rights divestment and wastage of the national wealth are posited as the main reasons for rejecting virtual currency by the opponents based on axiom of no loss, axiom of veneration and respect of the Muslims’ properties and axiom of wastage. Digital currency’s circulation is amongst the factors giving rise to the unjust distribution of wealth which is per se envisaged a threat to the Islamic economic system because more than half of the market volume of this type of money is presently held by few individuals who can impose embargos, threats, and jeopardies to the economy. Speculation is enumerated amongst the other factors of opposition because it is an activity performed with the objective of attaining profit via forecasting the price variations of the goods, securities or cryptocurrencies. The main motivation of the speculators in buying and selling various assets is the acquisition of profit. As viewed in individual jurisprudence, speculation is permitted if it is done within the framework of the canonical verdicts related to the sales and purchases and away from the cases denied in Islamic canon like false pretense and fraudulence and misleading interventions, hoarding, coalition (collusion), dispersion of false news and rumor, nominal transactions and so forth (Securities and stock exchange market organization, 2017).

These reasons cannot prove the legitimacy or prohibition of digital currency because every phenomenon is prone to misuse and the mere misuse likelihood cannot make one announce the prohibition of it. For instance, in the currency and stock exchange market, speculation is seen in the business deeds, as well, but nobody has ever become adequately persuaded to believe in its general prohibition. Yes, the persons performing speculation are considered as violators but the opponents’ proofs imply the illegitimacy of the speculator’s action. Thus, some believe that there are many issues put forth in the area of privacy, security, and risk in legal and legislative terms but the important thing is that a balanced set of legal codes should be reached between the development of blockchain technology and its legal stability. Of course, it has to be done assuming that the legal and regulatory dimensions do not bar the innovation in the current space (Kakavand et al., 2017).

But, Islamic Republic of Iran’s central bank has adopted a positive stance towards the digital assets and, meanwhile confessing to the creation of new opportunities and potential effects of cryptocurrencies’ circulation on the country’s monetary and currency policies in a document called “requirements and criteria of activity in the area of cryptocurrencies in the country”, in 2018. It warns that this type of currency makes threats directed at the general public and the organizations using it. Thus, in order to prevent the emergence of damages, support the consumers’ rights and facilitate the business in this area, it has declared the preliminary framework of the regulations related to cryptocurrencies. In this document, the policies related to such areas as initial coin offering (ICO), cryptocurrency-based exchanging offices and the related systems, cryptocurrency wallet and cryptocurrency extraction that can influence the monetary and financial policies of the country have been explicitly mentioned, but they are found not limited to these cases and can be possibly enforced for the other cases, as well. This document declares the position in respect to the four cryptocurrencies and it is stipulated that since the central bank cannot play a role in producing the universally accepted cryptocurrency, it cannot be used as a payment means inside the country but it is allowed to be bought and sold and exchanged only in currency exchange shops with their relevant regulations being mentioned in the section on the general requirements of the currency exchange offices. It has also been stated that the development of cryptocurrency wallet is permissible for universally accepted cryptocurrency considering the regulations related to the section on the cryptocurrency wallet for the real and legal persons. However, the extraction of the universally accepted cryptocurrencies is only viewed as an industry in the country and legislation in this area is beyond the scope of the central bank’s duties and supervision.

Dispersion of the national cryptocurrency has been declared permissible by the central bank of the Islamic Republic of Iran; so, it can be used as a means of payment but it has to be exchanged only in the permitted banks as well as the central bank of Islamic Republic of Iran. The dispersion of regional cryptocurrency is exclusively monopolized by the central bank like the dispersion of the national cryptocurrency; hence, it can be exchanged and used as a means of payment in the country in Islamic Republic of Iran’s Central Bank as well as in the permitted banks and currency exchange offices, the regulations of which have been mentioned in the section on currency exchange offices.

The non-prohibition of the development of cryptocurrency wallet for keeping tokens considering the regulations pertinent to the money wallet section has been enumerated amongst the requirements of the initial coin offering (ICO)/token which is divided in terms of support into two types of backed and unbacked with the former being per se categorized into four sets of Rial-backed, gold and other precious metals-backed, foreign currency (Dollar, Euro, etc.)-backed and tangible and intangible assets-backed. The requirements in the area of initial RIAL-supported coin/token offering are like those in the area of national cryptocurrency but the requirements of the gold and other precious metals-backed, foreign currency (Dollar, Euro, etc.)-backed and other tangible and intangible assets-backed cryptocurrency are different. As an example, dispersion of gold and other precious metals-backed tokens has been declared permissible after acquiring permission from the central bank and following the announcement of their being guaranteed in the country’s banks, so they can be exchanged in the permitted banks and currency exchange shops the regulations of which have been stated in the section related to the currency exchange offices. However, their use as a means of payment is prohibited in the country. The dispersion of foreign currency-backed token is exclusively monopolized by the banks licensed by the central bank and it can be exchanged in the permitted banks and currency exchange shops the regulations of which have been mentioned in the section related to the currency exchange offices, but its use as a means of payment is forbidden in the country.

The dispersion of other tangible and intangible assets-backed tokens is beyond the scope of the central bank’s supervision and authorities and follows the stock exchange regulations of Islamic Republic of Iran that will be codified and declared with the emphasis on the centrality of the stock and securities exchange market organization and in cooperation with the Islamic Republic of Iran’s central bank. This type of token can be exchanged in the goods and securities exchange market; but, its use as a means of payment is forbidden in the country. The dispersion of unbacked token is beyond the scope of the central bank’s duties and follows the regulations of Islamic Republic of Iran’s stock exchange market organization. The unbacked token can be exchanged in the goods and securities exchange market, but its use as a means of payment is forbidden in the country.

This document signifies that the Iranian government tends towards the authentication of the backed digital currency and the topic of the present discussion is also backed currencies because unbacked currencies are a sort of fraudulence and deception and their dispersion and circulation are not allowed as ruled in the Islamic law’s proofs. Therefore, the enactment in the thirtieth session of the supreme council of fighting against money laundry in 30th of December, 2017, declared prohibition of the application of Bitcoin and other virtual currency tools in all of the country’s monetary and financial centers for the reason that various kinds of virtual currencies feature the ability of being converted to an instrument of money laundry and financial supply of terrorism and, generally, displacement of the criminals’ monetary resources is not Iranian government’s main stance as it is recently declared by the deputy of central bank’s modern technologies that the decision for prohibiting the digital currency has not been finalized and it can be changed. Anyway, the emphasis has been made in the document “requirements and criteria of activity in the area of cryptocurrencies in the country” more on the prohibition of applying virtual currency instead of money but its absorption as an investment has not only been declared prohibited, but it has also been explicitly approved.

A wide variety of research conducted on digital currency examined it in monetary terms so it is natural for the majority of the states possessing the money monopoly to doubt it, but the present article investigates digital currency as an undeniable nature in terms of capital and digital asset. In economics, capital includes the right or the interests of the owners of an institution in its assets; furthermore, any money applied by a company in its economic activities has also been interpreted as capital (Mumbai stock exchange instruction institution, 2005, p.39). Investment, as well, includes an investor’s allocation of his or her owned and directly or indirectly controlled assets constituted of investment elements, including the requirement to the supply of capital or other resources, the expectation of income or profit and risk acceptance (Piran, 2010, p.21). The capital market is one of the financial subsystems of the economy alongside the monetary market. Capital market is the locus of exchanging financial instruments (securities), including shares, debt papers, and derived instruments. The main actors of this market are financial institutions that work based on certain principles and basics.

Some believe that initial coin offering (ICO) enables fast access to new investments (Cohan, 2017, p.7). The researches in digital banking and cryptocurrencies have made novel progresses with emphasis on mobile technologies and evolution in the use of encrypted currencies as financial assets. The participants have gone beyond the standard models for explicating the banking business models that are persistent and probably determine the future of financial supply (Dula and Chuen, 2018). Therefore, the smart assets refer to the properties formally identified by the government with their information being extensively registered in the form of retrievable codes (Wright and Filippi, 2015). Many efforts have been made for justifying the digital currency as the capital. As an example, in the structural research conducted based on Howey test for investment contracts and with policy-making objectives in line with regulating the securities exchange markets in terms of the encrypted assets or the so-called tokens like Bitcoin, Ethereum and the derived projects, it has been shown that there are three key variables, namely distribution, non-centralization, and capability, inside the token project’s software and the society launching and applying it (Valkenburgh, 2018).

In addition, a report was published in April 2015, by the European securities market administration (ESMA) that contained documentation regarding investment using virtual currencies or DLT indicating marginal investment in this area. In June 2016, as well, a report was published under the title of “distributed ledger technology in securities markets” in which the potential benefits and dangers the distributed ledger technology (DLT) could have in the securities market were reminded. However, the presented evidence showed that DLT has the capacity to use in financial markets (Kakavand et al., 2017).

Islamic capital market, as well, is one of the subsets of the Islam’s economic system with significant difference from the common capital market since the goals, principles, financial supply means, derived instruments and financial institutions are all being within the framework of the Islam’s economic principles in the Islamic capital market (Musavian, 2012). Thus, one of the important challenges of every newly emerging phenomenon in this market is the legitimacy and illegitimacy of the subject. As an instance, some believe that this money is more likely to be prohibited for the impossibility of creating a form of money similar to the bank-issued money bills and, on the other hand, it is not possible to provide legal-judicial support for this money due to the absence of the required documents considering the fact that the transferring of money sums in this type of currencies cannot be recognized and tracked (Mirghafuri et al., 2018).

But, it has to be noted that it is less possible to create money in this type of money and the absence of inflation effects and reduction in its value are amongst the other privileges of the virtual currency. Thus, it has been stated in the research by the securities exchange market organization that since Bitcoin is a sort of non-centralized money and bank and deposition are meaningless in it, it seems more justifiable in respect to the today’s unbacked money types (Securities and stock exchange market organization, 2017). On the other hand, like foreign money issued by a foreign government, the virtual currency can be considered as capital not as money featuring the same relinquishment power as the national money and being, on the one hand, a rival of the national money and faced with legal barriers on the other hand. That is because only the national money can have legal prevalence and relinquishment power as stated in paragraph B of article 2 of the country’s monetary and banking law and payment of any debt is only feasible through national money corresponding to paragraph C of the aforesaid law. Additionally, the digital currency has been investigated from several perspectives with respect to Islamic financial laws.

First of all, from the perspective of the governing regulations, some like Kahf believe that the Islamic investment is based on two maxims of justice and coordination with the human nature and reality; therefore, these two maxims should be observed in economic activities because otherwise, they would cause the investment outlying from the protective umbrella of the Islamic laws’ regulations. Some others, as well, have substantiated their reasoning in regard of the requirements of the Islamic financial regulations on five principles, namely prohibition of usury, loss, and risk, forbiddance of illegal acquisition of properties (gambling and betting) and existence of the item to be transacted, and believe, firstly considering the certainness of the total number of the Bitcoins (21 million), that interest payment is not a topic in this system. Secondly, mining operation in Bitcoin is not at all similar to gambling in which there is a losing and winning party and the winner or the loser is determined based on chance; whereas, in mining operation, every system capable of decrypting based on talent, not chance, would be rewarded with Bitcoin from the system (Bergestra, 2015).

Second, it has been investigated in monetary terms by some to see if the digital currency can be accepted as a money type based on the Islamic scales and regulations? And, can it be eventually welcomed as a sort of money featuring all the indices of the Islamic money so that the expansion of the Islamic financial instruments can be recommended based on it (Mufti, 2017). Moreover, the position of governmental money has been compared with that of Bitcoin in Islamic banking and it has been found more adapted to the axiom of “prohibition of usury” in Islam in contrast to the unbacked governmental money because the unbacked money is faced with the phenomenon of money creation and the subsequent money value reduction phenomenon, and it is not possible for a person who has borrowed 100 dollars to give back the same amount because the value of 100 dollars changes in the course of time with the money creation by the government. However, this problem is absent in Bitcoin and it can be solely extracted in the course of time (like gold) and its original source, i.e. 21 million Bitcoins, is fixed (Evans, 2015). The usury problem comes about in case of assuming the exchange of digital currencies with their own type, but it would be devoid of any usurious operation if it is exchanged for another currency or goods and services.

Third, the “materiality” of the cryptocurrency has been investigated because having materiality is in most cases like business, acquisitions are the prerequisite of the exchangeable items and in the jurisprudential theories, it is clear that the items exchanged for one another in every transaction should be accompanied with at least a profit so that the paying of price appear intellectual. Materiality is a term in jurisprudential literature meaning profitability which is interpreted in economic literature as an exchange value. Thus, exchange value and materiality are synonymous (Navvabpour, 2018).

It is examined in this regard whether materiality is nominal or real. For example, some believe that value and materiality, as well as value rank, are not inherent characteristics of the objects meaning that they are not the real attributes of an object in itself and disregarding the human beings’ appraisal, and they are not also nominal meaning that they are not merely conventional and related to the real states of the objects, rather they are traits related to the real states of the objects, i.e. they are related to the objects’ evolution characteristics based on their specifications and natures and/or based on their accidental features and the objects gain value based on the effects caused by them (Motahhari, 1989). Some others are of the belief that materiality is an intellectual credit stemming from an object possessing a feature making the people become more inclined towards it in such a way that the people compete with one another in acquiring it (Hakim, 1992). Some others believe that the credibility of materiality in objects is only due to the reason that they are liked very much (Khomeini, 1994). Some others, as well, realize the value of goods exchange as being equal to the social inclinations towards them and believe that the exchange value of every good is related to the satisfaction of the human needs by means of those goods and the social interests in certain goods originate from the usefulness and value of their consumption (Sadr, 2003).

In the end, some have presented the theory of “credentiality/nominal value of money” to legitimize the use of encrypted moneys with the only challenging point, as put by them, being the creation of disorder in economy in regard of the idea that if the use of these money leads to damage to the country’s general economy, it is not permissible from the jurisprudential perspectives based on the axiom “no imposition and suffering of loss is allowed in Islam” (Solaimanipour, 2016). It seems firstly that materiality is the nominal property that brings about typical profitability, exchangeability, and ratability in an object (Bariklou, 2011). That object might be even nominal. For instance, the interests of the landed properties do not externally exist but they have been considered in Islamic laws as possessing materiality hence being envisioned as property. Thus, the materiality of the assets exchangeable in the market should not be doubted. Secondly, capital is not limited to properties rather it has been developed within its realm. As an example, it is stipulated in article 1 of the law on the encouragement and support of the foreign investment that “foreign capital is the various kinds of capital including cash or noncash that are imported by the foreign investors into the country”. These capitals can be of the following types:

If the digital currency cannot be placed in one of the first five rows, it can be surely grouped with the last row’s items. Thus, every legitimate object causing an increase in the employment rate or production of wealth can be considered as capital. As found in the research by the securities and stock exchange organization, Bitcoin can be realized as a sort of intellectual property the materiality and economic value of which are accepted by the intellectuals, as well, considering the invention of mathematical algorithms existing in Bitcoin network for transferring of the sums in B2B processes. In other words, like intellectual property, Bitcoin possesses value and materiality and can undergo a price increase due to the limitations in supply and increase in demand (Securities and stock exchange market organization, 2017). But, problems related to lack of legislation, notable risk (Rajabi, 2018) and absence of formal legal solutions are subjects that necessitate the legislation in the area of cryptocurrencies as capitals. The conditions of digital asset absorption and smart contract have been pointed out below as some solutions in private law.

The use of digital currency as capital is suspended on the legal identification of the smart contracts and solving the infrastructural challenges of endorsing these contracts in the legal system. Amongst these infrastructures, the necessity for identification of the digital currency and perfect and correct registration of the property and other assets, material or nonmaterial, in the legal systems can be first pointed out. That is because the assets can be transferred within the format of the smart contracts identified formally by the government with their information being registered within the format of the encrypted codes on blockchain grounds (Wright and Filippi, 2015).

Secondly, the use of digital signatures for concluding transactions should be permitted because the individuals need to acquire permission for using digital signature so as to be able to sign and endorse smart contracts the same way that the individuals should present the communication inspection organization in the US and other developed countries with their identity and owned properties’ deeds, legal statuses and criminal records as well as the other relevant information so that they can be provided with private keys. This organization investigates the documents and inquires the required information from the qualified authorities and grants private keys for endorsing smart contracts to the applicants in case of their being verified (Sadeghi and Naser, 2018).

Thirdly, the possibility of owning virtual currencies should be provided in adherence to the convention on the unification of virtual currencies-based transactions, passed in 2017, by international business law commission. The other legal aspects of these contracts like the law governing the lawsuits upon the occurrence of discrepancies and filing cases in the courts and the qualified court to try the case and the contract endorsement place, as well, are investigated in accordance to the generalities of the country location of contract conclusion in case that that the two parties of a contract are citizens of a country. But, in case that there is an international element entered the contract; some believe that the countries’ legal systems are confronted with gaps so they need to enact new regulations for ruling the duties and rights in this regard (Sadeghi and Naser, 2018). However, it seems that the law most relevant to the contractual contents would be the most appropriate.

In case that these conditions are met, the smart contracts are signed under the supervision of the qualified authorities and artificial intelligence and following endorsement by the parties, they will be also re-read by the artificial intelligence and the contractual items will be enforced and registered in the readable codes of the blockchain in case of the contract’s overall match with the instruction. These contracts, like settlement contracts, can take the place of any other agreement, possessory or promissory ones included. The possessory contracts are signed within the format of the goods ownership conveyance for money sums or goods or contractually exchangeable items that may be digital assets like token, encrypted currencies like Ethereum or smart properties.

The smart contract is the proper legal solution for absorbing digital assets. Considering the fact that the development of the electronic business leads to the creation of three generations of electronic contracts, namely contracts based on binary signatures, data-based contracts and smart contracts (Sadeghi and Naser, 2018), the smart contract is the proper legal solution for absorbing digital currency. The smart contract is the phrase first used more than 20 years ago by Nick Szabo. From his perspective, “many of the contractual effects and compensations, like mortgage, bond, delimitation of asset rights, etc. can be provided in the existing software and hardware in such a way that the violation of the contract can be rendered costly for the parties”. He knew automatic sale tools (vending machines) as prototypes of such contracts because they receive the money sum and deliver the product to the second party of the contract (Islamic Consultative Assembly’s research center, 2018). In 2009, the invention of such digital currency as Bitcoin by Satoshi Nakamoto on blockchain ground paved the way for the authentication of the smart contracts. It was with the creation of such a digital currency as Ethereum due to the decline in Bitcoin’s value that the financial and, of course, more highly secure markets allowed Ethereum cryptocurrency-based transactions and its replacement for Bitcoin as a digital cryptocurrency and this set the ground for endorsing more advanced and safer smart contracts (Reyes, 2016).

Although some smart contracts are of software type and are not legally considered contract as held by some for the reason that they use the distributed ledger in such a way that it can be able to keep the financial records in an automatic manner and execute the contents of multilateral agreements simultaneously (Sadeghi and Naser, 2018), these contracts are very much similar to contract-free transaction in Imamiyyah Jurisprudence as identified in article 339 of Iran’s civil law, as well. In this type of contract, the contract formation and enforcement stages have been blended and the enforcement of the action subject of the contract, including the transferring of a property or performing of an action, is envisaged as contract endorsement. As an instance, based on contract-free transaction system, a greengrocer bunched his vegetables into several sets and stuck price labels on them and placed a money pot or box at the side of them and the buyers had to deposit money thereafter picking up their intended vegetables for whatever the amount and it was in this way that a transaction of the contract-free type was established between them with the contracts’ law regulations governing the parties’ interrelationships. In the DLT world, as well, a smart contract is a computer protocol, an algorithm that can specify and run the contracts’ contents based on the given instructions (Reyes, 2018). For instance, blockchain includes novel technologies grouped in the set of smart business and, as a general headnote containing digital currencies, enables the currency holder enter electronic contracts in accordance to the permit issued by the qualified authorities and take measures in line with making payment using the virtual currencies in exchange for transferring the ownership of the intended commodity.

As for the distributed ledger, there is not a definition agreed by all the researchers but the World Bank (2017) realized DTL as “special application of a vast set of shared ledgers” through which it is possible for the different partners to commonly record their data. Also, European Central Bank has defined DTL as a technology that allows its users to keep and have access to the information related to a certain set of assets and shareholders in a common transaction and account database (Cambridge Center for Alternative Finance, 2018, p.19).

Anyhow, blockchain is a non-centralized digital head note incorporating digitally encrypted currencies being widely used in various areas of law. The primary function of this headnote in the law-related areas is providing the possibility of registering information, transferring information and enforcing contracts’ contents. Every block encompasses registered information and every chain connects the blocks through a function to one another. Smart contracts are signed on this ground. So, the smart contracts can be defined as legal actions endorsed on blockchain ground with them being exchanged as specified in the contracts for virtual currencies or smart assets. Furthermore, this ground possesses transnationality for it has been developed to various parts of the world and it is not solely limited to one or several countries. In addition, cash payment in the smart contracts is needless of the existence of an external intermediary like bank and it is carried out via an electronic wallet or through cloud space in a direct form with one advantage of it being immunity of the contracts endorsed on this ground against bankruptcy or banking sanctions.

Smart contracts can be justified from the perspective of legal regulations and economic interests. From the legal regulations’ viewpoint, the spontaneous implementation of the smart contracts and their role in the security of the transaction system are amongst the advantages of such types of contracts. As held by some, the self-running property pertains to contractual contents’ enforcement without the involvement of a third person and also to the exertion of the contractual obligations’ nonperformance mandates, hence leading to the development of the transaction system considering it is accompanied by security elevation, cost reduction as well as speed and accuracy augmentation in transaction endorsement (Sadeghi and Naser, 2018). From an economic viewpoint, as well, this type of contract is efficient in allocation of transaction costs, fighting against the contractual opportunism and apportionment of the contractual dangers with the objective of safeguarding the social welfare (Habibi, 2010, p.13). Therefore, the economic aspect of the smart contracts is more accentuated in the future and digital world and such contracts can be identified and supported as “collective contracts (Katouziyan, 2001)” in which groups of individuals are usually established for achieving a common “unified” goal through creating legal personality as in the case of the companies or without creating legal personality like in the composition deeds. Resultantly, the credibility of the smart contracts should not be doubted considering the principle of the contracts’ consensual nature (Bariklou, 2015, p. 29) and accepting the transactional method of contract endorsement in Islamic jurisprudence under the title of contract-free transactions.

Considering the self-running trait of the smart contracts, the authentication of them in Iran’s legal system provides a legal solution for absorbing digital currency and can lead to the creation of change in such sectors as deed registration, financial markets, insurance and bank (Sadeghi and Naser, 2018). As an example, in the area of the deed registration, it is via endorsing and registering new contents in the smart contracts that the parties would become needless of any registration in the notary public offices. As it is stated in article 6 of the electronic business, passed in 7th of January, 2011, the electronic text or “data message”, produced or sent by originator so as to be received by addressee and digitally signed by the generator and the receiver, is to be envisioned as a traditional text and, as ruled in article 7 of the same law, when the existence of signature is deemed necessary by the law, the electronic signature would be sufficient” (Shams, 2011, pp. 91 & 95). Additionally, in financial and capital markets like stock and over-the-counter exchange markets, the self-running property of these contracts would be largely effective in developing transaction security and facilitating the properties’ exchange in terms of transferring securities in the form of electronic tokens of the supply chain and supported loans. In the insurance area, transparency causes reductions in insurance firms’ misuse of the policyholders’ unawareness; in the banking area, as well, this causes an increase in transparency in banks’ performance and elevation of security in transferring sums of money between the national and transnational banks.

Therefore, considering the fact that security and trust are two major pillars in every business, it is evident that the achievement of the electronic business’s daily increasing development goals inside the country as well as internationally entails enjoyment of modern instruments for creating the infrastructures and the basics required for entering the business world. However, the emergence of digital technology and its expediencies in business exchanges and relations’ level necessitates identification of the new theories and regulations along with the private law’s traditional regulations; although the enactment of the electronic business law has been considered by some as a favorable start in this process (Rezazadeh and Rostamzadeh, 2013, pp. 81 & 87). However, it is not adequate, and the advantages of the virtual world and technologies, including cryptocurrencies, should be purposively utilized without any meanness and take steps in line with timely management of the issue thereby to minimize its disadvantages with authentication of smart contracts being one of the ways of employing digital currency.

CONCLUSION:

Cryptocurrencies, including the universally accepted encrypted currencies, initial coin offering or tokens, as well as the regional cryptocurrencies are amongst the digital assets the circulation and existence of which is outside the government’s authority. They are like undeniable, unpreventable or inevitable realities. Thus, it is necessary to manage them by taking advantage of legal mechanisms and financial instruments. The majority of the studies in the area of cryptocurrencies have investigated them as money but this approach is confronted with two legal problems: firstly, based on the country’s monetary regulations, only the prevalence of the national money is lawful and only this money has the power of relinquishment and payment; thus, if another money is circulated in addition to the national money, its monetary credibility needs to be approved in certain laws but the economic and social grounds of such a law is yet to be set. Secondly, assuming the enactment of a new law and legitimacy of the cryptocurrencies’ circulation as money, the competition between them and the governmental money would lead to the elimination of national money from the money market, on the one hand, with it bringing about crisis in the entire banking system of the country and, on the other hand, the competition between the numerous cryptocurrencies, backed and unbacked, would result in all the consumers’ sustaining of losses that endangers the public and economic order of the society.

Thus, the present study concentrated on considering cryptocurrencies as sorts of virtual assets and capitals and stated that this phenomenon has to be somehow relatively managed thereby to absorb into the part of the Iranian society’s wandering liquidity that is playing with the general public’s essential needs on a daily basis. Also, it is by accepting the cryptocurrencies as the capital that jobs can be created and economic booming can be assisted provided that the virtual space is not ruled by political and security-related matters.

Meanwhile, reaching a positive appraisal of the deed passed in 2018 by the central bank, the current research paper offered reasons for investable nature of the cryptocurrencies following the investigation of the legal conditions and solutions of their intake and it was accordingly proved that Iran’s legal system has the capacity to provide the legal conditions for absorbing these cryptocurrencies as capital and it can simultaneously authenticate and support the smart contracts as the legal solution for absorbing the cryptocurrencies through rectifying the effective causes following the identification and recognition of contract-free transactions in Islamic jurisprudence and civil laws.

References

Bariklou, A., (2011), Financial properties and laws, Tehran: Samt.

Bariklou, A., (2015), Contracts’ laws, Tehran: Mizan Legal Foundation

Bergestra, J. (2015). Bitcoin and Islamic finance version 3. Informatic system, university of Amsterdam.

Cambridge center for alternative finance. (2018). Distributed Ledger Technology Systems: A Conceptual Framework. Cambridge: university of Cambridge.

Dula, C., & Chuen, D. (2018). Reshaping the Financial Order. San Diego, CA: SMU Academic Press.

Evans, C. (2015). Bitcoin in Islamic banking and finance. Journal of Islamic banking and finance, 1-11.

Habibi, B., (2010), Economic analysis of the private law, Tehran: Majd.

Hakim, A., (1992), Nahj Al-Fiqaha, Tehran: 22nd of Bahman Publication Institute.

Islamic Republic of Iran’s Central Bank, (2018), Requirements and criteria of the cryptocurrency area, Iran, Tehran.

Kakavand, H., Kost De Sevres, N., & Chilton, B. (2017). The Blockchain Revolution: An Analysis of Regulation and Technology Related to Distributed Ledger Technologies. SSRN.

Katouziyan, N., (2001), General regulations of the contracts, 3rd ed., 439-440.

Khomeini, R., (1994), Al-Makaseb Al-Moharrameh, v.1, Tehran.

Mirghafuri, S., Sayyadi, H., & Dehghanizadeh, N., (2018), Advantages and disadvantages of digital currencies with an emphasis on Bitcoin, conference on the modern researches in sciences and technologies.

Moore, T. (2013). The promise and perils of digital currencies. International Journal of Critical Infrastructure Protection 6, 147–149.

Motahhari, M., (1989), A glance at the Islamic economy system, Tehran: Sadra.

Mufti, F. (2017). A Research on money and bitcoin according to Islamic Law and economics. www.darulfigh.com.

Mumbai Stock Exchange Instruction Institution, (2005), Alphabet of capital market, tr. Hamid Reza Arbab, Tehran, Stock Exchange Organization Press.

Musavian, S., (2012), Islamic capital market (1), Tehran: Islamic culture and thought research center.

Navvabpour, A., (2018), Jurisprudential analysis of the functions of cryptocurrencies (case study: Bitcoin), Qom, MA dissertation, Islamic teachings and management department.

Piran, H., (2010), Legal issues of international investment, Tehran: Ganj-e-Danesh.

Rajabi, A., (2018), Virtual currency, legislation in various countries and suggestions for Iran, research center of Islamic Consultative Assembly.

Reyes, C. (2018). Cryptolaw for Distributed Ledger Technologies: A Jurisprudential Framework. Jurimetrics J.

Reyes, C. L. (2016). Moving beyond Bitcoin to an endogenous theory of decentralized ledger technology regulation: An initial proposal. Villanova Law Review, 191.

Rezazadeh, M. & Rostamzadeh, A., (2013), International laws in the mirror of the day’s sciences, Academic Jihad Publication.

Sadeghi, M. & Naser, M., (2018), Considerations for legal policy-making in the smart contracts, seasonal scientific, research journal of public policy-making, 4(2): 143-167.

Sadr, M., (2003), Our economy, tr. Seyed Mohammad Mahdi Borhani, Dar Al-Sadr Publication Institute.

Securities and stock exchange market organization, (2017), Bitcoin and financial nature-virtual money jurisprudence, Tehran: securities and stock exchange market organization, research, development and Islamic studies research center, markets and financial tools department.

Shams, A., (2011), Proofs for claim justification, Tehran: Darrak.

Solaimanipour, A., (2016), Jurisprudential investigation of virtual money, bi-seasonal journal of Islamic financial research.

Tasca, P. (2015). Digital Currencies: Principles, Trends, Opportunities, and Risks. Deutsche Bundesbank and ECUREX Research.

Valkenburgh, P. V. (2018). Framework for securities regulation of Cryptocurrencies. Coin Center Report.

W.Chohan, U. (2017). Assessing the Differences in Bitcoin & Other Cryptocurrency Legality across National Jurisdictions. Canberra: University of New South Wales.

W.Chohan, U. (2017). Initial Coin Offerings (ICOs): Risks, Regulation, and Accountability. Discussion Paper Series: Notes on the 21st Century, 7.

Wright, A., & Filippi, P. D. (2015). Decentralized Blockchain Technology and the Rise of Lex Cryptographia. SSRN Electronic Journal.

Bariklou, A., (2011), Financial properties and laws, Tehran: Samt.

Bariklou, A., (2015), Contracts’ laws, Tehran: Mizan Legal Foundation

Bergestra, J. (2015). Bitcoin and Islamic finance version 3. Informatic system, university of Amsterdam.

Cambridge center for alternative finance. (2018). Distributed Ledger Technology Systems: A Conceptual Framework. Cambridge: university of Cambridge.

Dula, C., & Chuen, D. (2018). Reshaping the Financial Order. San Diego, CA: SMU Academic Press.

Evans, C. (2015). Bitcoin in Islamic banking and finance. Journal of Islamic banking and finance, 1-11.

Habibi, B., (2010), Economic analysis of the private law, Tehran: Majd.

Hakim, A., (1992), Nahj Al-Fiqaha, Tehran: 22nd of Bahman Publication Institute.

Islamic Republic of Iran’s Central Bank, (2018), Requirements and criteria of the cryptocurrency area, Iran, Tehran.

Kakavand, H., Kost De Sevres, N., & Chilton, B. (2017). The Blockchain Revolution: An Analysis of Regulation and Technology Related to Distributed Ledger Technologies. SSRN.

Katouziyan, N., (2001), General regulations of the contracts, 3rd ed., 439-440.

Khomeini, R., (1994), Al-Makaseb Al-Moharrameh, v.1, Tehran.

Mirghafuri, S., Sayyadi, H., & Dehghanizadeh, N., (2018), Advantages and disadvantages of digital currencies with an emphasis on Bitcoin, conference on the modern researches in sciences and technologies.

Moore, T. (2013). The promise and perils of digital currencies. International Journal of Critical Infrastructure Protection 6, 147–149.

Motahhari, M., (1989), A glance at the Islamic economy system, Tehran: Sadra.

Mufti, F. (2017). A Research on money and bitcoin according to Islamic Law and economics. www.darulfigh.com.

Mumbai Stock Exchange Instruction Institution, (2005), Alphabet of capital market, tr. Hamid Reza Arbab, Tehran, Stock Exchange Organization Press.

Musavian, S., (2012), Islamic capital market (1), Tehran: Islamic culture and thought research center.

Navvabpour, A., (2018), Jurisprudential analysis of the functions of cryptocurrencies (case study: Bitcoin), Qom, MA dissertation, Islamic teachings and management department.

Piran, H., (2010), Legal issues of international investment, Tehran: Ganj-e-Danesh.

Rajabi, A., (2018), Virtual currency, legislation in various countries and suggestions for Iran, research center of Islamic Consultative Assembly.

Reyes, C. (2018). Cryptolaw for Distributed Ledger Technologies: A Jurisprudential Framework. Jurimetrics J.

Reyes, C. L. (2016). Moving beyond Bitcoin to an endogenous theory of decentralized ledger technology regulation: An initial proposal. Villanova Law Review, 191.

Rezazadeh, M. & Rostamzadeh, A., (2013), International laws in the mirror of the day’s sciences, Academic Jihad Publication.

Sadeghi, M. & Naser, M., (2018), Considerations for legal policy-making in the smart contracts, seasonal scientific, research journal of public policy-making, 4(2): 143-167.

Sadr, M., (2003), Our economy, tr. Seyed Mohammad Mahdi Borhani, Dar Al-Sadr Publication Institute.

Securities and stock exchange market organization, (2017), Bitcoin and financial nature-virtual money jurisprudence, Tehran: securities and stock exchange market organization, research, development and Islamic studies research center, markets and financial tools department.

Shams, A., (2011), Proofs for claim justification, Tehran: Darrak.

Solaimanipour, A., (2016), Jurisprudential investigation of virtual money, bi-seasonal journal of Islamic financial research.

Tasca, P. (2015). Digital Currencies: Principles, Trends, Opportunities, and Risks. Deutsche Bundesbank and ECUREX Research.

Valkenburgh, P. V. (2018). Framework for securities regulation of Cryptocurrencies. Coin Center Report.

W.Chohan, U. (2017). Assessing the Differences in Bitcoin & Other Cryptocurrency Legality across National Jurisdictions. Canberra: University of New South Wales.

W.Chohan, U. (2017). Initial Coin Offerings (ICOs): Risks, Regulation, and Accountability. Discussion Paper Series: Notes on the 21st Century, 7.

Wright, A., & Filippi, P. D. (2015). Decentralized Blockchain Technology and the Rise of Lex Cryptographia. SSRN Electronic Journal