Impacts of Firms’ Characteristics on Leverage Ratio in Emerging Real Estate Market

Linh Hoai DO 1*, Thang Xuan NGUYEN 2, Chi Van LE 3, Giang Linh NGUYEN 4

1 National Economics University, School of Banking and Finance, Department of Banking Management, Vietnam.

2 National Economics University, Graduate School, Vietnam.

3 National Economics University, School of Banking and Finance, Department of Monetary and Financial Theories, Vietnam.

4 National Economics University, International School of Management and Economics, Vietnam.

These authors contributed equally to the work

*Corresponding author:

E-mail: linhdh @ neu. Edu .vn

ABSTRACT

The purpose of this study is to investigate the impacts of firms’ characteristics on leverage ratio in emerging countries with the case of real estate listed enterprises in Vietnam. We have employed panel data analysis for regression, with short-term debt ratio (STDTA), long-term debt ratio (LTDTA), and total debt ratio (TTDTA) as the response variables. Based on the sample of 32 real estate companies listed on both Hanoi Stock Exchange (HNX) and Ho Chi Minh Stock Exchange (HOSE) during the period from 2010 to 2018, the estimated results from these three models are quite different. The results show that short-term leverage is influenced by firms’ profitability, size, growth opportunities, risk, age, and liquidity. However only risk and liquidity have an impact on long-term leverage. Total leverage is affected by firms’ size, risk, age, and liquidity. Also, a remarkable result from the regression models is that tangibility and non-debt tax shield do not have any influence on leverage ratio. Firms’ liquidity has a significant reverse effect on short-term leverage and total leverage. However, liquidity has a significant positive impact on long-term leverage. Accordingly, the authors propose some discussions for firms to choose an optimal capital structure to maximize the firm’s value. We suggest that real estate firms should not rely heavily on debt finance. They should be financed through several channels which are funds, insurance funds, and venture capitals rather than rely heavily on banks. While profitable firms could use retained earnings to cover most of their investments without publishing information to outsiders, high forecast growth but low profitability firms could use debt financing.

Keywords: Leverage ratio, liquidity level, firm age, firm profitability, firm size

INTRODUCTION

Capital is the most concern because it determines the growth-path of firms (1). Organizations can deal with other organizations and shall handle their duties through these capitals (Keshvarz et al., 2017; Chakeri et al., 2018; Zarei et al., 2019). Firms need capital to finance their machinery, materials, and labors to serve for production. Sorted by the origin, then capital is divided into debt and equity. When the owner’s equity is not enough, firms will raise more funds from outsiders, which then marks the existent of debt. In reality, rarely do any companies use equity as their only source of finance, and so does credit financing. Hence, capital structure is defined as the optimal combination between equity and debt. The main concern of financial policy decisions of any business is about capital structure, which refers to a rational combination among debt, hybrid equities, and equity. Optimal capital structure is required to satisfy 2 things: (1) minimize weighted asset cost of capital, and (2) maximize the firm’s value (Deangelo and Masulis, 1980). Modigliani and Miller (1958) documented that firm’s value can be increased by taking more leverage, while Lang et al. (1994) highlighted that firms with high leverage ratio have difficulties in raising outside fund, and expose highly to the underinvestment problem, and different levels of leverage were seen in cross-industries (Bowen et al., 1982). Two types of categories pose a different impact on capital structure, which are internal and external factors. External factors include numerous elements such as typical elements of industries, borrowing interest rates, and financial policy. In contrast, internal factors comprise characteristics of firms such as tangibility, profitability, and growth opportunities. In the emerging market, real estate activities account for 30% of the total activities of the whole economy (Hung, 2007). The real estate industry requires constant and long-term sources of funds, but in fact, the statistics reveal that almost all firms in emerging markets show heavy dependence on short-term debt, mainly from banks (Vinh, 2015). Hence, it highlights the fact that these real estate firms have not used their capital effectively and need to change external debt management. Therefore, the authors aim at investigating the impact of firms’ characteristics on leverage ratio: evidence from Vietnamese real estate listed companies.

1. LITERATURE REVIEW

The pioneering work of Modigliani and Miller (1958) concluded in their findings that there is no role of capital structure in a perfect capital market, where they assumed that there is an absence of corporate profit taxation and bankruptcy penalties, no transactions or bankruptcy costs, no distortionary taxation. Thus, this conclusion got seriously criticized because of its unreality. First of all, they ignored the existence of transaction costs, as well as the bankruptcy cost. Bankruptcy cost comprises direct cost which includes administrative expenses such as trustee fees, referee fees, and legal fees, and the time lost by executives (Baxter, 1967). Due to limited assumptions, their working in 1963 added the impact of corporate taxes, the personal tax was added by Myers (1977), and bankruptcy cost by Titman (1984). Since the existence of those costs, Jensen and Meckling (1979); Myers (1977) introduced agency costs as an explanation for the relationship between principals and agencies. The late 1970s marked the existent of two new theories which are the “trade-off theory”, and another based on the impact of information asymmetries is “pecking order theory” (Myers and Mailuf,1984; Chen and Strange, 2005).

1.1. Theoretical Background

1.1.1. Trade-off Theory (TOT)

Financial distress, if defined as firms’ inability of meeting the whole or a part of their financial obligations, can lead to bankruptcy. When facing financial difficulties, companies must bear certain costs, both direct and indirect costs. Direct costs include court-related costs, attorneys, experts, and accountants. Also, there are administrative costs in the case of bankruptcy proceedings. Indirect costs can take many forms. In the event of bankruptcy, the postponement can lead to the conflict between parties, which may last a couple of years, then to the devaluation of assets. Managers and employees may face the risk of jobless and decreasing reputation. This situation may motivate managers to take actions that could harm the companies’ long-term interest. These actions include reducing maintenance of machines, the sale of high-value assets, and lack of enthusiasm in management.

TOT states that the company exchanges the tax benefits from debt against the deadweight costs of debt funding (Djaddan et al., 2017). Firms’ reputation can be enhanced by taking more debt, which opposes the view of Modigliani and Miller in 1958. Banks as well as debt providers may charge higher-risk insurance if the company is high in debt. Hence TOT suggests that companies should balance the benefit from debt tax shield and the cost of debt. Hirshleifer (1966) suggested that both taxes and bankruptcy costs should be seriously considered when making decisions. Financing by debt is used as the tax-shield, and it can maximize firms’ value if the benefit from the shield equals the marginal cost of debt, like the agency costs and the bankruptcy costs as suggested by Gaud et al. (2005) when studying about 104 Swiss companies. The same opinion is also found in the working of Ross (1977) and Graham and Harvey (2001).

However, this theory has limitation is that it cannot interpret why capital structures are different among firms which have the same tax rate (Chen and Strange, 2005). Copeland et al. (2005) evidenced that the capital structure of studied United States firms did not show any significant difference with the impact of corporate tax. Similarly, with the sample of developing countries, Booth et al. (2001) found no role of tax benefits in capital structure decisions, and it is only used as a proxy for profitability.

1.1.2. Pecking order theory (POT)

Based on asymmetric information between insiders (managers) and outsiders (investors), Myers and Mailuf introduced pecking order theory in 1984. Myers and Mailuf (1984), and Frank and Goyal (2005) stated that pecking order theory is complementary for trade-off theory, while Harrison and Widjaja (2014) concluded that the trade-off theory contains less power of explaining for post and prior crisis than the pecking order theory. Unlike trade-off theory, no optimal capital structure suggestion is given under pecking order theory, but the most suitable vary between firms.

This theory proposes that the unequal information in two parties resulting in costly external financing. When the shares are overvalued, managers will decide to issue more shares, which then, in turn, devalued the share price (Brigham and Ehrhardt, 2013). Firms with bright future performance would rather not finance through new share offerings, while firms with poor prospects are more likely to take outside equity. Retained earnings are not exposed to serious adverse selection like equity is, so it is safer to use retained earnings rather than external debt. An outside investor evaluates equity riskier than debt, then a higher rate of return and risk premium is required (Frank and Goyal, 2003). For the case of the real estate industry, which requires long-term investment because of lumpy productive capacity, firms tend to stockpile retained earnings for leverage reduction. There is a time lag between the point physical expenditures are made and the time investment begins to generate cash. Once this time lag finishes, new capital is considered as productive capital that can generate income (Tsyplakov, 2008). In the line of pecking order theory, a common phenomenon is the owners’ desire of controlling the firm, and maintaining independence (mac an Bhaird and Lucey, 2010). Hence when internal equity is inadequate, firms use debt financing before using external equity as last resort.

1.1.3. Agency Cost Theory

In 1979 Jensen and Meckling introduced the agency cost theory as explanations for the nexus of two parties - principals, and agencies. The leverage ratio of firms is affected by the agency cost, which occurs when there are conflicts between two groups: agents and principals (Harris and Raviv, 1991).

1.1.3.1. Managers (Agents) Versus Shareholders (Principals)

Agency cost arises due to the diverse interest between managers and shareholders. Managers’ job is to increase the benefit of shareholders, but in fact, they hesitate in doing that because they bear the whole cost of refraining if these project fails, but only gain a part of it if they succeed. Consequently, it leads to the transformation of firms’ resources into their benefits such as perquisites such as cars or luxury offices. In this case, debt will be used as discipline devices to reduce the probability that free cash flow will be misused (Harris and Raviv, 1990). Another conflict arises when managers want to pursue growth to reduce the risk of take-over, but shareholders want dividends. As a result, debt will be used by managers to promise the future dividend pay-out. Jensen (1986) argued that free-cash-flow can be paid dividends or kept retained earnings, and both will lead to the conflict of related parties. Shareholders want to receive dividend while managers want to receive benefits from the firm’s expansion, which then lead to the over optimal size expansion. Hence, another way to reduce free-cash flow is increasing fixed obligation by taking more debt.

1.1.3.2. Shareholders (Agents) and Creditors (Principals)

The conflict between shareholders and debtholders arises because shareholders have an incentive to invest in risky projects. When the company is financially healthy, shareholders get a higher dividend, but debt-holders only receive a fixed amount. In a downturn, default on the debt will give debt-holder more power in hand, in the end, equity holders face the risk of “going to broke” (Booth et al., 2001).

1.2. Developing a hypothesis and theoretical model

1.2.1. Hypothesis

1.2.1.1. Tangibility

Based on the pecking order theory, the working of Harris and Raviv (1991) proved that firms with a low level of tangibility are encouraged to issue debt since a high level of asymmetric information exposure if not equity issuing is practical only when firms decide to under-price them. Also, a high level of tangibility means less information asymmetry (firms’ value should be clearer to the market), then they have less incentive to resolve information asymmetry problems.

As collateral, tangible assets such as property, infrastructures, and equipment can lead to the reduction of borrowing costs (Berger and Udell, 2002). Similarly, firms with high tangibility less prone to asymmetric information problems and can avoid high costs. From the view of lenders, the more tangible assets a firm has, the higher the ability to secure the debt. A high level of tangible assets is easier for debt providers to value than intangibles assets namely brand recognition, trademarks, and goodwill, which then lower the expected distress costs.

In case of bankruptcy, a greater level of tangible assets will have more liquidation value than the intangible ones. Furthermore, debt financing is a good financial decision to reduce the agency problems since it will be used as collateral upon to secure the debt. Therefore, firms that use tangibility as collateral, find it difficult in shifting their investment to riskier projects due to asset constraints of banks and debt holders, which is explained in the line of agency cost theory (Bevan and Danbolt, 2002). Thus this paper will use fixed assets to total assets to represent the degree of asset tangibility like in previous research (Rajan and Zingales, 1995). And the positive relationship between tangibility and leverage ratio will be tested under the following hypothesis:

H1: Tangibility has negative impact on leverage ratio.

1.2.1.2. Profitability

On one hand, pecking order theory states that internal financing is more preferable for high-profit firms because of its lower cost when compared with an external cost. All things being equal, with a fixed payout ratio, a highly profitable firm will have more retained earnings which then lower the debt financing.

On the other hand, high profitability firms should increase their debts to offset taxes as suggested by the trade-off theory. Also, according to Gaud et al. (2005), if past profit is used as a proxy for future profit, it will increase the likelihood of a firm’s paying back when in higher leverage. In the economy when the tax rate is high, it is more reasonable for firms to take more debt to increase financial expenses, and then lower tax payables. Also, high profitable firms may subject to free cash flow problems, in which taking more leverage might be effective governance. ROE is a basic test of whether managers use investors’ money effectively or not, so it will be used to measure profitability. Thus, there is an expectation that profitability will have a positive impact on leverage.

H2: Profitability has positive impact on leverage ratio.

1.2.1.3. Firm size

Large firms are subject to more news than the small ones because the investment community would be more concerned with information about large firms. This makes large firms are more closely observed by analysts and less subject to information asymmetry than small firms, so they may have less reliance on debt finance (Rajan and Zingales, 1995). If a firm is currently funded by debt financing, firms will be restricted to a specific project, constrained fund sources (Hillier et al., 2011). This result consists of the research of Titman and Wessels (1988), which reveals that the sampled large firms tend to use less debt financing than small firms due to their low volatility in cash flow, and low default risk. For those reasons, the pecking order theory is consistent with firm size being negatively related to leverage.

From the viewpoint of the trade-off theory, a firm’s trade-off between the benefits of leverage, such as tax savings and mitigation of agency problems, against the costs of leverage, such as the costs of bankruptcy. Small firms may bear a higher likelihood of bankruptcy because of high exposure to asymmetric information, and less financial record which was showed in the research of Frank and Goyal (2003). Their conclusion may be consistent with the view that small firms may be exposed to greater investment frictions than those large ones because of investment frictions (Shyam-Sunder and Myers, 1999). Large firms can obtain better credit ratings and do not have to resolve information asymmetries with debt providers (Esperanca et al., 2003). This study will use a common proxy for a firm’s size which is the natural logarithm of total assets as in the work of Titman and Wessels (1988); Rajan and Zingales (1995), and Vinh (2017). Hence a positive relationship is expected following the hypothesis.

H3: The firm’s size has a positive impact on leverage ratio.

1.2.1.4. Growth opportunities

Following pecking order theory, when an internal fund is insufficient, firms tend to get from debt issuing as the second preferable choice. Especially, for firms with high growth opportunities, which have a close relationship with banks can borrow with lower cost since the modest level of asymmetric information (Gaud et al., 2005). As the managers’ reluctance to issue equity, high-growth firms with large financing demand will end up with a high gearing ratio (Frank and Goyal, 2003). Based on the above arguments, it is suggested that the pecking order theory is consistent with growth opportunities being positively related to leverage.

Market timing theory states that high growth opportunities firms will issue equity when they are highly evaluated (high stock prices) (Huang and Ritter, 2009). Jensen (1986) shows the same opinion, firms with high growth in the future only have a high level of intangibility, which cannot be used as collateral, stated by trade-off theory. Moreover, future growth opportunities have not yet generated revenue, companies may not take additional debt financing at this stage (Barclay et al., 2006). Many prior pieces of research conclude that managers and shareholders often choose to invest in risky portfolios in exchange for higher revenue in return. This results in the unwillingness of creditors to give credit unless they are offered a reasonable risk premium. Thus, a negative impact of future growth on long-term debt due to the effect of asymmetric information as stated in the study of Gaud et al. (2005), and Barclay et al. (2006). However, as stated above, the conflict of high agency costs can be mitigated by using short-term debt (Myers, 1977). Additionally, convertible debt is another useful tool to tackle this problem, suggested by Green (1984). Consequently, the growth in sales will be used to measure the affection of growth on gearing ratio, and a negative correlation is predicted.

H4: Growth has a positive impact on leverage ratio.

1.2.1.5. Non-debt tax shield

In general, firms are less willing to provide information to the market (investors and competitors), instead they use internal funds so that they just have to provide minimal information. According to Chakraborty (2010), when the corporate tax rate is high, high depreciation is more preferable because it may minimize taxable income and maximize profit after tax. As a result, a non-debt tax shield can be used as a substitute tax discount method. There should be a positive relationship between non-debt tax shields and leverage as suggested by pecking order theory (Boquist and Moore, 1984).

In contrast, when depreciation expense is already high, firms tend to have fewer benefits from potential tax advantage of debt since they reduce the amount of income that can be exposed to fixed debt tax shield benefits. Ozkan (2001) concludes that there is no evidence proving that a non-debt tax shield correlates to borrowing decisions. Nevertheless, researchers should pay attention to interpreting results because the proxy for this variable may be a measurement for other effects. For instance, a firm with a high depreciation ratio is more likely to have higher tangible assets, which in turn suggests a positive influence on leverage ratio based on the agency cost theory. Therefore, this study will use depreciation expenses as the main measurement of non-debt tax shield and expect a positive correlation of this variable as argued by the trade-off theory.

H5: non-debt tax shield has a positive impact on leverage ratio.

1.2.1.6. Business risk

Greater uncertainty and information asymmetry are results of increased risk. Hence, riskier firms tend to take more debt to relieve information asymmetry. Therefore, risky firms prefer debt finance, and firm risk is positively related to leverage in the line with pecking order theory. If the company determines to finance its project with completely new debt, then they have to warrant that future revenue from that project can meet its obligation. When the investment is lumpy and takes a long time to build before generating earnings, then a higher interest rate will be imposed. A gloomier outlook for the company is that its earnings are below the interest payment, forcing the company to default without finishing their new incremental assets. Taking this circumstance into consideration, the company may choose to issue equity rather than debt financing for its incremental investment. Note that this case needs lumpy investment, long-time to build, and low earnings than interests at the same time to induce such financial behavior. Ooghe et al. (2008) argue that firms are likely to pay more attention to assets and liability management because it can reduce the risk of future cash flow maybe not adequate to pay off the debt. Debt with shorter maturity than in-build-assets are risky whenever profit is not generated enough to cover interest payment. Similarly, debt with longer maturity than assets is risky because debt has to be returned after the assets have ceased to create more income. Trade-off theory states that financial distress is highly associated with business risk due to the volatility in earnings. Also, it is not worth wasting tax-shield when the income of the company is low, so risk and leverage negatively related (Frank and Goyal, 2005). Similarly, for future underinvestment mitigation, high volatility firms are likely to cumulate cash in bloom periods in the framework of pecking order theory. Hence, to measure business risk, this paper will use the standard deviation of return on equity (ROA) which was used in previous empirical analysis such as Chen and Strange (2005), and Pathak (2010), and a negative relationship is reasonable for this variable.

H6: Risk has a negative impact on leverage ratio.

1.2.1.7. Age

On one hand, the trade-off theory predicts that older firms with a better reputation in the capital market tend to take in more debt due to lower debt-related agency costs and low bankruptcy costs (Frank and Goyal, 2009). Start-up and early-stage companies often find it difficult to raise more capital for several reasons. Firstly, internal resources are limited because at this stage retained earnings are typically not adequate, as well as owners’ resources. Secondly, information opacity combines with less trading record will be exacerbated by low collateralizable assets, then restricts approaches to external debt. Hence early-stage firms tend to be financed by business angels and less debt financing (Berger and Udell, 1998). Once the firm has reached the mature stage, it accumulates assets in the form of inventory, and infrastructure which then will be used to pledge. Also, at that time, sufficient trading and credit history will allow the firm to get different sources of finance (mac an Bhaird and Lucey, 2010).

On the other hand, in agreement with pecking order theory, firms that reach the later phase of their business cycle often have enough sufficient retained earnings to finance their investment, and they are less dependent on external sources than younger firms do (Petersen and Rajan, 1994). With different maturity of capital projects, mature firms can use the profit of this project to finance the others, augmenting internal sources of funds. Hence, the natural logarithm of the firm’s age since incorporation should play a vital role in determining financial decisions, and this study expects it will negatively relate.

H7: The firm’s age has a negative impact on leverage ratio.

1.2.1.8. Liquidity

Esperanca et al. (2003) and mac an Bhaird and Lucey (2010) argued that short-term debt is generally used to cover contemporary deficits, so the level of liquidity is considerably important for creditors in giving short-term credit. Firms with a high liquidity ratio might take in more debt because of the greater ability to sell liquidity assets to cover obligations when in need. Consequently, this suggests that liquidity correlates positively to leverage ratio.

However, based on the pecking order theory, firms with high liquidity levels can have the ability in financing their investment with their own money, and less depending on external debt financing (Ozkan, 2001). The agency theory proposes that outside creditors tend to limit their debt financing when the costs of liquidity are high. Moreover, liquid assets not only give greater liquidation value for creditors but also give borrowers more freedom to act at creditors’ expense (Myers and Rajan, 1998). As a result, this study will verify this negative relationship, and it will be measured by the current ratio, which indicates the ability of firms in covering the short-term obligations as in the research of Pathak (2010).

H8: Liquidity has a negative impact on the leverage ratio

Table 1: Hypotheses and advocated theories

|

Hypotheses |

Advocated theories |

|

H1: Tangibility has negative impact on leverage ratio |

Pecking order theory |

|

H2: Profitability has positive impact on leverage ratio. |

Trade-off theory + Agency cost theory |

|

H3: The firm’s size has a positive impact on leverage ratio. |

Trade-off theory |

|

H4: Growth has a positive impact on leverage ratio. |

Pecking order theory |

|

H5: non-debt tax shield has a positive impact on leverage ratio. |

Pecking order theory |

|

H6: Risk has a negative impact on leverage ratio. |

Trade-off theory |

|

H7: The firm’s age has a negative impact on leverage ratio. |

Pecking order theory |

|

H8: Liquidity has a negative impact on leverage ratio. |

Pecking order theory |

Source: own research

1.2.2. Definition of dependent variables, and explanatory variables:

In verifying the major impact of a firm’s characteristics on the leverage ratio, it is necessary to make clear the definition of leverage. A board concept of gearing is the ratio of total liabilities to total assets. This ratio is extracted from the view of shareholders to measure what they will receive in the case of liquidation.

However, this is not an ideal indication of evaluating firms’ health. Since payables that are used for transaction payment may overstate the real leverage situation of firms (Miguel and Pindado, 2001). A more favorable approach of financial leverage is the ratio of long-term and short- term debt to total assets. Ideally, for the real estate sector, long-term debt is used to finance projects that last several years. However, as presented above, the real estate sector in Vietnam tends to rely more on short-term debt. Hence, this paper will consider long, short-term debt, and total debt ratio. With the aim of deep investigation of insight in capital structure determinants, 8 explanatory variables are selected to create a potential set of capital structure determinants.

Table 2: Definitions of dependent variables

|

Dependent variables |

Variable definition |

|

STDTAf,t |

Short-term debt/ total assets of firm f in year t |

|

LTDTAf,t |

Long-term debt/total assets of firm f in year t |

|

TTDTAf,t |

Total debt/total assets of firm f in year t |

Source: own research

Table 3: Definitions of explanatory variables

|

Independent variables |

Definition |

Expected result |

|

TANGf,t |

Fixed assets/Total assets of firm f in year t |

(-) |

|

PROFf,t |

ROE of firm f in year t |

(+) |

|

SIZEf,t |

Natural logarithm of total assets of firm f in year t |

(+) |

|

GRf,t |

Growth in sales of firm f in year t |

(+) |

|

NDTSf,t |

Depreciation expense/Total assets of firm f in year t |

(+) |

|

RISKf,t |

The standard deviation of ROA of firm f in year t |

(-) |

|

AGEf,t |

Natural logarithm of the firm’s age of firm f in year t |

(-) |

|

LIQDf,t |

Current assets/current liabilities of firm f in year t |

(-) |

|

uf,t |

Error term |

|

Source: own research

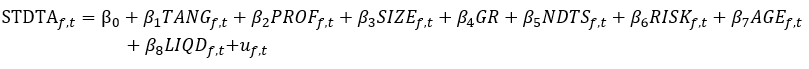

Based on those above hypotheses, dependent variables, as well as explanatory variables, there are 3 models will be examined in this paper

Model 1:

Model 2:

Model 3:

2. RESEARCH METHODOLOGY

2.1. Data

The impact of firms’ characteristics on debt ratio will be put under consideration with 32 real estate Vietnamese companies listed on Hanoi stock exchange (HNX) and Ho Chi Minh stock exchange (HSX) during 2010-2018, covers a set of 285 observations. The data are extracted from the public income statement, and balance sheets of all firms from Cophieu 68.com; Vietstock, and Indirect. Perhaps, it is much better to use market value unless it is available. However, according to Bowman (1980), book and market value shows a high level of correlation, so using book value in calculating does not lead to considerable misspecification. According to Myers (1977), managers prefer to book leverage over the market because market leverage is a doubtful indicator for making financial decisions. Furthermore, in practice many firms use book value to set leverage structure (Titman, 1984); and also a large number of managers reveal that they do not adjust their capital structure in response to the volatility in the capital market (Graham and Harvey, 2001).

2.2. Regression Models

To verify the relationship between the firm’s characteristics and leverage ratio, this study will use panel data analysis for regression. The use of panel data has several advantages such as considerably increasing the sample size, repeating spatial observations with more information (Baltagi, 2008).

Through descriptive statistics, the current situation of real estate companies’ capital structure is analyzed and evaluated. By using STATA, regression coefficients are determined, then models that reflect the impacts of firms’ characteristics on leverage ratio are constructed.

Table 4: Breusch and Pagan Lagrangian multiplier test for the random effect

|

Model |

Chi2(1) |

Prob > Chi2 |

|

Model 1: short-term leverage |

157.04 |

0.0000 |

|

Model 2: long-term leverage |

425.43 |

0.0000 |

|

Model 3: total leverage |

296.56 |

0.0000 |

Source: own research

First of all, Breusch and Pagan Lagrangian multiplier test is used to choose between pooled ordinary least square (POLS) and Random Effect Model (REM) with the hypothesis:

H0: POLS is correct

Ha: REM is correct

From Table 4, we can see that the test result in every model is below 0.05. Therefore, the null hypothesis H0 is rejected, and we will consider REM is correct. After that, the most suitable among the Fixed Effect Model (FEM) and Random Effect Model (REM) is chosen via the Hausman test (Nachane, 2006). This test allows us to see the correlation between independent variables and unobserved effect variables.

H0: REM is correct

Ha: FEM is correct

Table 5: Hausman test results

|

Models |

Chi2(8) |

Prob>chi2 |

|

Model 1: short-term leverage |

10.66 |

0.2217 |

|

Model 2: long-term leverage |

72.73 |

0.0000 |

|

Model 3: total leverage |

0.22 |

1.0000 |

Source: own research

The results of the Hausman test are mixed, REM is suggested for model 1 and 3, while model 2 is best performing with FEM. Whereas, model 2 is recommended to be the best with the Fixed Effect model which introduces an individual-unique intercept term and can deal with explanatory variables and firms’ unique effects (Verbeek, 2008). Then multicollinearity, cross-sectional, autocorrelation, and heteroscedasticity problems will be tested.

Table 6: Problems checking

|

Test |

Model 1 |

Model 2 |

Model 3 |

|||

|

Pesaran's test of cross-sectional independence |

|

Pr |

|

Pr |

|

Pr |

|

|

0.781 |

0.4350 |

-1.379 |

0.1680 |

-0.052 |

0.9587 |

|

Wooldridge test for autocorrelation |

F(1, 31) |

Prob > F |

F(1, 31) |

Prob > F |

F(1, 31) |

Prob > F |

|

|

32.602 |

0.0000 |

22.600 |

0.0000 |

48.083 |

0.0000 |

|

Panel Groupwise Heteroscedasticity Tests |

Wald Test |

P-Value >Chi2(32) |

Modified Wald test: chi2 (32) |

Prob>chi2 |

Wald Test |

P-Value >Chi2(32) |

|

|

9.14e+04 |

0.0000 |

2057.20 |

0.0000 |

1.94e+05 |

0.0000 |

Source: own research

Test for cross-sectional:

H0: there is no cross-sectional

Ha: cross-sectional problem

Test for autocorrelation

H0: no first-order autocorrelation

Ha: autocorrelation problem

Test for heteroscedasticity

H0: Panel Homoscedasticity

Ha: Panel Groupwise Heteroscedasticity

Additional models, for cross-sectional checking, have a probability of more than 5%, which means that there is no cross-sectional. However, presented results in Table 6 from autocorrelation checking, and heteroscedasticity testing reveal that all models have a probability of less than 5%, we should reject the null hypothesis and conclude that all models are suffering from autocorrelation and heteroscedasticity problem. Hence, to fix all the mentioned problems, models with robustness will be performed in the following chapter.

2.3. Data Description

2.3.1. Descriptive statistics

Table 7: Descriptive Statistics

|

Variables |

Mean |

Median |

Sdt.dev |

Minimum |

Maximum |

|

STDTA |

0.312 |

0.297 |

0.186 |

0.003 |

0.967 |

|

LTDTA |

0.188 |

0.141 |

0.192 |

0 |

1.153 |

|

TTDTA |

0.487 |

0.496 |

0.211 |

0.011 |

1.273 |

|

TANG |

0.077 |

0.031 |

0.118 |

0.001 |

0.711 |

|

ROA |

0.039 |

0.032 |

0.046 |

-0.128 |

0.233 |

|

ROE |

0.086 |

0.065 |

0.097 |

-0.212 |

0.612 |

|

SIZE |

13.639 |

13.859 |

2.189 |

0.003 |

17.068 |

|

GR |

12.238 |

0.129 |

1.496 |

6.429 |

16.307 |

|

NDTS |

0.027 |

0.008 |

0.131 |

0 |

2.167 |

|

RISK |

8.856 |

2.754 |

14.527 |

0.006 |

76.906 |

|

AGE |

2.203 |

2.303 |

0.511 |

0 |

3.218 |

|

LIQD |

3.875 |

2.233 |

6.146 |

0.034 |

64.046 |

Source: own research

In the above table, the dependent variables are: STDTA refers to short-term leverage, LTDTA refers to long-term leverage, and TTDTA represents total debt leverage. The explanatory variables include Tangibility (TANG), Profitability (ROE), firm size (SIZE), growth (GR), non-debt tax shield (NDTS), risk (RISK), and firm age (AGE).

Table 7 shows the descriptive statistics for the leverage variables and eight independent variables for the sample of Vietnamese real estate firms. During the period 2010-2018, the average of short-term debt and long-term debt is 31.2 percent and 18.8 percent in order, indicating that 48.7 percent of firms’ total assets are financed through leverage. It implies that Vietnamese real estate companies are mainly financed by short-term debt since Vietnam is a bank-based country (Son, 2008). Tangibility has an average value of 0.0766, which means that on average 7.66% of total assets are represented by fixed assets.

The profitability variable has a mean (median) of 8.611 (6.538), indicating that Vietnamese real estate firms, on average, earned an 8.6 percent return on equity over the sample period. In terms of means, the average size of the firm is 13.639 with 2.189 volatility. The growth variable ranges from a 6.429 percent minimum value to a 16.307 maximum value. The non-debt tax shields variable has a mean (median) of 0.027 (0.008), indicating that 2.7 percent of total assets are accounted for depreciation each year.

The risk variable experiences the highest level of fluctuation with 14.527 standard deviations and ranges from a 0.006 minimum value to a 76.906 maximum value. Firm age has a mean (median) value of 2.203 years (2.303 years), indicating that the average Vietnamese real estate firm has been in operation for just a short time. In terms of means, the average liquidity level is 3.875 with 6.146 volatility, ranging from the minimum value of 0.034 to the most liquid firm with 64.046 in maximum value. Correlation matrix will be used to control for multicollinearity, and expected signs of explanatory variables are also employed.

Table 8: Pairwise correlation coefficients among variables

|

STDTA |

LTDTA |

TTDTA |

TANG |

ROE |

SIZE |

GR |

NDTS |

RISK |

AGE |

|

|

STDTA |

1.0000 |

|||||||||

|

LTDTA |

-0.3540* |

1.0000 |

||||||||

|

TTDTA |

0.5131* |

0.5403* |

1.0000 |

|||||||

|

TANG |

-0.3515* |

0.1642* |

-0.1711* |

1.0000 |

||||||

|

ROE |

-0.1529* |

0.3810* |

0.1937* |

0.0474 |

1.0000 |

|||||

|

SIZE |

0.2172* |

-0.0734 |

0.1229 |

-0.2548* |

0.0039 |

1.0000 |

||||

|

GR |

0.0714 |

-0.0176 |

-0.0702 |

0.0179 |

0.0022 |

-0.0078 |

1.0000 |

|||

|

NDTS |

-0.1024 |

-0.0089 |

-0.1008 |

0.0753 |

-0.0296 |

-0.1209 |

-0.0238 |

1.0000 |

||

|

RISK |

0.4590* |

-0.0955 |

0.3591* |

-0.1725* |

0.0337 |

0.0032 |

-0.0853 |

-0.0337 |

1.0000 |

|

|

AGE |

-0.0808 |

0.0734 |

-0.0240 |

-0.0983 |

0.0318 |

0.1605* |

-0.0557 |

0.1124 |

-0.0750 |

1.0000 |

Source: own research

STDTA refers to short-term leverage, LTDTA refers to long-term leverage, and TTDTA represents total debt leverage. The explanatory variables include Tangibility (TANG), Profitability (ROE), firm size (SIZE), growth (GR), non-debt tax shield (NDTS), risk (RISK), and firm age (AGE).

Table 8 presents the correlation matrix of short, long, and total debt to total assets with eight independent variables. In general, tangibility, and age hurt short and total debt, but long-term debt. Short-term leverage has a negative relationship with profitability, but positive with size, growth, and risk. However, long-term leverage has the opposite pattern when comparing short-term leverage. The pattern of total leverage seems to follow that of short-term, except for positive with profitability and negative correlation with growth. Since all correlation coefficients are under 0.5, so there is no evidence to suspect multicollinearity among independent variables.

3. EMPIRICAL RESULTS

3.1. Results

The goodness of fit (R2) of the first model is 0.4430, which indicates that 44.3% of the change in short-term debt can be explained by the model 1. However, as lower R2, so the explanatory power of model 2 and model 3 is less than that of model 1.

To meet the robustness of regression, a couple of diagnostic tests such as The Breusch-Pagan Lagrange Multiplier test (1980), and Hausman test are performed to choose among pooled Ordinary Least Square (POLS), Fixed Effects Model (FEM), and Random Effects Model (REM). The Hausman specification test is employed to test the superiority of the Fixed Effects model versus the Random Effects specification. The result from STATA software suggests that models 1 and 3 are the best fit with the Random Effects model, which implies that the explanatory variables and the firms’ unique effects are not correlated. In other words, the differences among firms do not follow any rules. In terms of the adjustment for autocorrelation and heteroscedasticity problems, a robust option is used in every model, the results are presented in Table 9.

Table 9: Results from 3 models reflecting determinants of a leverage ratio

|

STDTA |

LTDTA |

TTDTA |

||||

|

Fixed Effects |

Random Effects |

Fixed Effects |

Random Effects |

Fixed Effects |

Random Effects |

|

|

Constant |

0.3591*** |

0.3357*** |

0.1604** |

0.1576** |

0.5275*** |

0.5071*** |

|

(0.0614) |

(0.0611) |

(0.0535) |

(0.0596) |

(0.0697) |

(0.0737) |

|

|

TANG |

-0.0441 |

-0.0731 |

-0.0630 |

-0.0453 |

-0.1869* |

-0.1669 |

|

(0.0824) |

(0.0772) |

(0.0718) |

(0.0716) |

(0.0936) |

(0.0920) |

|

|

ROE |

-0.0028*** |

-0.0029*** |

0.0002 |

0.0008 |

-0.0022* |

-0.0014 |

|

(0.0008) |

(0.0008) |

(0.0007) |

(0.0007) |

(0.0010) |

(0.0010) |

|

|

SIZE |

0.0067 |

0.0085* |

0.0030 |

0.0019 |

0.0095* |

0.0088* |

|

(0.0039) |

(0.0037) |

(0.0034) |

(0.0034) |

(0.0044) |

(0.0044) |

|

|

GR |

0.0057** |

0.0059** |

-0.0002 |

-0.0003 |

-0.0026 |

-0.0026 |

|

(0.0020) |

(0.0020) |

(0.0017) |

(0.0018) |

(0.0023) |

(0.0023) |

|

|

NDTS |

0.0124 |

0.0009 |

-0.0372 |

-0.0346 |

-0.0196 |

-0.0237 |

|

(0.0522) |

(0.0515) |

(0.0454) |

(0.0462) |

(0.0593) |

(0.0603) |

|

|

RISK |

0.0031*** |

0.0033*** |

-0.0011* |

-0.0011* |

0.0027*** |

0.0028*** |

|

(0.0005) |

(0.0005) |

(0.0004) |

(0.0004) |

(0.0006) |

(0.0006) |

|

|

AGE |

-0.0482* |

-0.0475* |

-0.0095 |

-0.0041 |

-0.0655** |

-0.0558* |

|

(0.0207) |

(0.0189) |

(0.0180) |

(0.0178) |

(0.0235) |

(0.0227) |

|

|

LIQD |

-0.0102*** |

-0.0107*** |

0.0059*** |

0.0058*** |

-0.0038* |

-0.0042* |

|

(0.0015) |

(0.0014) |

(0.0013) |

(0.0013) |

(0.0016) |

(0.0016) |

|

|

No. of observations |

285 |

285 |

285 |

285 |

285 |

285 |

Source: own research

In the above table, the dependent variables are: STDTA refers to short-term leverage, LTDTA refers to long-term leverage, and TTDTA represents total debt leverage. The explanatory variables include Tangibility (TANG), Profitability (ROE), firm size (SIZE), growth (GR), non-debt tax shield (NDTS), risk (RISK), and firm age (AGE).

***, **, and * denote significance at the 1%, 5%, and 10% levels, respectively

The result from Table 9 implies that PROF harms STDTA, indicating that if ROE increases by 1 unit, then short-term leverage will decrease by 0.0029 unit. With a positive relationship, when a firm increases size, growth opportunities, and risk by 1 unit, then short-term leverage will increase by 0.0085, 0.0059, and 0.0033 unit respectively. In contrast, when age and liquidity level increase by 1unit, short-term leverage will decrease by 0.0475 and 0.0107 units in order.

For long-term leverage, only risk and liquidity are significant, so a conclusion is drawn indicating that when a firm bears one more level of risk, they tend to take a lower of 0.0011 unit in debt. When a firm stands at one unit higher of liquidity level, then they tend to take a higher of 0.0059 unit of long-term leverage.

In terms of total leverage, when a firm decides to increase its size of one more unit and exposed to a higher level of risk, then an increase of 0.0088 and 0.0028 units are expected respectively. However, when a firm gains more operation year, and a higher level of liquidity, they are likely to take a lower of 0.0558, and 0.0042 unit of debt.

DISCUSSION

Short-term debt Ratio (STDTA)

Table 9 shows the regression results for the short-term debt ratio (STDTA) dependent variable. From hypothesis 1, the variable representing the tangible assets is expected to hurt STDTA, but it is not statistically significant. The result from Table 9 implies that PROF harms STDTA, indicating that if profitability increases by 1 unit, then short-term leverage will decrease by 0.0029 unit, and can be explained by the pecking order theory. Firms with high profitability can have the ability to generate enough revenue to cover short-term obligations. Hence, they are mainly financed by their cash, and then less use of external debt, which in the line with trade-off theory. This result is consistent with Booth et al. (2001) and Zeitun and Tian (2008).

The firm’s size variable is positively correlated, and statistically significant at 5% with STDTA, which is consistent with hypothesis 3. The large firm size will have a greater reputation in the capital market, lower debt-related agency problems, so they have more choices in using short-term debt. This positive relationship is also seen in Rajan and Zingales (1995) and Frank and Goyal (2009), which support the trade-off theory.

From the growth prospect, it is positively related, and statistically significant at 10% with STDTA. We can conclude that it is consistent with pecking order theory, which states that high growth firms’ managers are reluctant to issue equity, and only takes short-term debt to finance their investment and expect higher future retained earnings due to high growth. This result supports pecking order theory when firms prefer debt financing over issuing equity, and a similar result is also seen with the work of Ross (1977)

A non-debt tax shield is positively associated with STDTA but absorbs no significance of real estate firms. Real estate firms tend to have high fixed assets, which refers to a high level of depreciation than other industries. Such a high depreciation will not encourage firms to take more debt to take advantage of the non-debt tax shield. However, hypothesis 5 cannot be met in any model, which implies that tax-shield from having high depreciation expenses is not taken into consideration when managers make a financial choice. A similar result is shown in the study of Titman and Wessels (1988). Risk is statistically significant and positively correlated with STDTA. When firms increase their level of risk 1 unit, then they tend to increase their leverage by 0.33 unit, and significant at 1% confidence interval. This result is in the same line with the study of Chen and Strange (2005) when investigating Chinese listed firms.

AGE is negatively correlated, and statistically significant in model 1, pointing out that companies at the mature stage can generate enough revenue to cover their investment financing without using external sources in the short-term. Therefore, this explanatory variable supports pecking order theory when firms prefer their resource rather than borrowing from outsiders. LIQD seems to have a negative relationship with STDTA. We can conclude that the liquidity level of real estate firms has a greater influence on short-term leverage. A reasonable explanation is that in the short-term, firms with high liquidity levels can cover their current obligation when in need, so there is no need in taking more debt, which is proved by pecking order theory. The result of liquidity is consistent with the work of Zeitun and Tian (2008), Proença et al. (2014), and Vinh (2017).

Long-term debt Ratio (LTDTA)

From model 2 of the long-term debt ratio, all variables except for Risk and Liquidity are statistically significant. In the long-term, we can draw a conclusion that when a firm increases 1 level of risk, they tend to borrow less, which is strongly supported by trade-off and pecking order theory. It means that it is not worth wasting tax shields, and companies with high volatility in earnings tend to cumulate their earnings to spend during a hard time. However, GR is not related to long-term debt in model 2 which has the same view as Cortez and Susanto (2012) when investigating the Japanese market. A reasonable explanation is that growth only reflects the past performance of firms, and it cannot predict future growth. Hence, when taking long-term debt, growth is not a vital component when managers decide financing choices. As in the work of Titman and Wessels (1988), there is no impact of the non-debt tax shield on leverage ratio.

Risk is negatively correlated with LTDTA, so hypothesis 6 is not rejected in model 2. In the long-term, as the uncertain of the return, firms may be assessed as risky, creditors may be more cautious in lending. Hence firms find difficulties in access to debt, which is also found by Titman and Wessels (1988), and Pathak (2010). LIQD seems to positively associate with LTDTA. Hence, in longer-term high liquidity firms tend to use liquidity assets as collateral to show external creditors healthy financial situations to lend a larger amount of debt. Consequently, long-term leverage is affected positively by liquidity level.

Total debt Ratio (TTDTA)

SIZE, RISK, AGE, and LIQD are found to be statistically significant with the total debt ratio. When tangibility is no significant with debt level, we may refer that these companies may take debenture that does not require tangible assets as collateral. High liquid companies can meet their obligation of debt when it is fall due. For example, following the Resolution 02/NQ-CP in 2014 there is a pack of 30 thousand VND from SBV for supporting housing credit, which causes banks to ease in lending, and more confident in the real estate sector (Novaland, 2014). Consequently, there is no need in taking more debt when there is a high level of liquidity. This result is the same as Zeitun and Tian (2008) and opposes the study of Proença et al. (2014). The firm’s size variable is positively correlated, and statistically significant at 5% with TTDTA, which is consistent with hypothesis 3. However, profitability, growth, and non-debt tax shield do not seem to have any influent power on total debt leverage. Similar to long-term debt, there is no evidence showing that growth rate has any impact on total debt leverage which consists of the work of Titman and Wessels (1988), and Cortez and Susanto (2012).

To conclude, expected results, regression results, as well as advocated theories for each model are presented in Table 10. As can be seen from the table, for the short-term leverage model (model 1) there are 6 variables out of 8 that are significant, and two of them do not accept the hypotheses. In model 2 about long-term leverage, only two explanatory variables are significant, and the liquidity variable does not follow the expected result. Model 3 about the total leverage model shows 4 significant independent variables, and the only risk variable is not consistent with hypothesis 6. In short, this paper is in favor of pecking order theory over other theories.

Table 10: Results and advocated theories

|

Dependent variables |

Explanatory variables |

Expected results |

Results |

Advocated theories |

|

Short-term Leverage (STDTA) |

Profitability (PROF) |

(+) |

(-) |

Pecking order theory |

|

Firm size (SIZE) |

(+) |

(+) |

Trade-off theory |

|

|

Growth opportunities (GR) |

(+) |

(+) |

Pecking order theory |

|

|

Risk (RISK) |

(-) |

(+) |

Pecking order theory |

|

|

Age (AGE) |

(-) |

(-) |

Pecking order theory |

|

|

Liquidity (LIQD) |

(-) |

(-) |

Pecking order theory |

|

|

Long-term Leverage (LTDTA) |

Risk (RISK) |

(-) |

(-) |

Trade-off theory |

|

Liquidity (LIQD) |

(-) |

(+) |

||

|

Total debt Leverage (TTDTA) |

Firm size (SIZE) |

(+) |

(+) |

Trade-off theory |

|

Risk (RISK) |

(-) |

(+) |

Pecking order theory |

|

|

Age (AGE) |

(-) |

(-) |

Pecking order theory |

|

|

Liquidity (LIQD) |

(-) |

(-) |

Pecking order theory |

Source: own research

CONCLUSIONS

The paper investigates the impacts of firms’ characteristics which are tangibility, profitability, firm size, growth opportunities, non-debt tax shield, risk, age, and liquidity on the leverage ratio of Vietnamese real estate companies over the period from 2010 to 2018. The results reveal the different impact of these variables on short-term leverage, long-term leverage, and total debt leverage, and mainly support pecking order theory. A noticeable result from regression is that tangibility and non-debt tax shield do not have any influence on leverage ratio. In terms of tangibility we can conclude that during the examined time, firms may use debenture that does not require tangible assets as collateral. Also, the ease in lending in of SBV 2014 indicated that the lending standard at that time for real estate companies did not take tangibility into account.

Recommendation

These implications shed new light on Vietnamese real estate firms to make more effective financial decisions. There is no optimal capital structure that one size fits all, so the manager should construct the most suitable capital structure for their companies with a diverse set of funding sources. Firms in real estate sectors tend to have high depreciation expenses as high volume of fixed assets, so there are not many benefits from non-debt tax shields. This paper suggests that real estate firms should not rely heavily on debt finance in response to Circular 19/2017/TT-NHNN since this source of funds is going to be dried up. Instead, they should be financed through several channels which are funds, insurance funds, and venture capitals rather than rely heavily on banks.

For profitable firms, it is more favorable to use retained earnings to cover most of their investments without publishing information to outsiders (investors and competitors). However, for firms whose profitability is low but with high forecast growth, then they will be compelled to resort to debt. It will depend on what life-cycle stage that the company is standing at. They can compute Altman Z-score to see the distance from bankruptcy to compare the benefits and drawbacks of debt financing to have the lowest cost of debt but can increase the firm’s value.

Limitations and further study recommendations

This study has several limitations, which relate to the size and time duration of the sample. First of all, it only covers the period of 8 years from 2010 to 2018, so the length is not long enough to evaluate companies’ trends of development. Secondly, the sample size only includes 32 firms, and these companies do not simply work in the real estate sector, but also others. Further researches can study the impact of industry on leverage ratio as it is typical for each sector. Lastly, another limitation lies in the way of collecting and analyzing data because all data are extracted from financial statements of firms, which means that assets’ value is all calculated based on book value without taking market value under consideration. Since the limited development of the Vietnam stock market and accounting standards in presenting financial statements, there are difficulties in using market value.

References

Baltagi, B. (2008). Econometric analysis of panel data. John Wiley & Sons.

Barclay, M. J., Smith Jr, C. W., & Morellec, E. (2006). On the debt capacity of growth options. The Journal of Business, 79(1), 37–60. https://doi.org/10.1086/497404.

Baxter, N. D. (1967). Leverage, risk of ruin, and the cost of capital. The Journal of Finance, 22(3), 395–403. https://doi.org/10.2307/2978892.

Berger, A. N., & Udell, G. F. (1998). The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance, 22(6–8), 613–673. https://doi.org/10.1016/S0378-4266(98)00038-7.

Berger, A. N., & Udell, G. F. (2002). Small business credit availability and relationship lending: The importance of bank organizational structure. The Economic Journal, 112(477), F32--F53. https://doi.org/10.1111/1468-0297.00682.

Bevan, A. A., & Danbolt, J. (2002). Capital structure and its determinants in the UK-a decompositional analysis. Applied Financial Economics, 12(3), 159–170. https://doi.org/10.1080/09603100110090073.

Booth, L., Aivazian, V., Demirguc-Kunt, A., & Maksimovic, V. (2001). Capital structures in developing countries. The Journal of Finance, 56(1), 87–130. https://doi.org/10.1111/0022-1082.00320.

Boquist, J. A., & Moore, W. T. (1984). Inter-Industry Leverage Differences and the DeAngelo-Masulis Tax Shield Hypothesis. Financial Management, 13(1), 5–9. https://doi.org/10.2307/3665118.

Bowen, R. M., Daley, L. A., & Huber Jr, C. C. (1982). Evidence on the existence and determinants of inter-industry differences in leverage. Financial Management, 10–20. https://doi.org/10.2307/3665227.

Brigham, E. F., & Ehrhardt, M. C. (2013). Financial management: Theory & practice. Cengage Learning.

Copeland, T. E., Weston, J. F., Shastri, K., & others. (2005). Financial theory and corporate policy. Addison-Wesley Boston, MA.

Cortez, M. A., & Susanto, S. (2012). Testing theories of capital structure and estimating the speed of adjustment. Journal of International Business Research, 11(3), 121–134. https://doi.org/10.1017/S0022109009090152.

Deangelo, H., & Masulis, R. W. (1980). Optimal capital structure under corporate and personal taxation. Journal of Financial Economics, 8(1), 3–29. https://doi.org/10.1016/0304-405X(80)90019-7.

Djaddan, S., Ghozali, I., & others. (2017). The Role of Business Risk and Non-Debt Tax Shields to Debt to Equity Ratio on Pharmacy Listed Companies in Indonesia. International Journal of Economics and Financial Issues, 7(2), 73–80.

Esperanca, J. P., Gama, A. P. M., & Gulamhussen, M. A. (2003). Corporate debt policy of small firms: an empirical (re) examination. Journal of Small Business and Enterprise Development. https://doi.org/10.1108/14626000310461213.

Frank, M. Z., & Goyal, V. K. (2003). Testing the pecking order theory of capital structure. Journal of Financial Economics, 67(2), 217–248. https://doi.org/10.1016/S0304-405X(02)00252-0.

Frank, M. Z., & Goyal, V. K. (2005). Trade-off and pecking order theories of debt. The Handbook of Empirical Corporate Finance. Elsevier Science. https://doi.org/10.1016/B978-0-444-53265-7.50004-4.

Frank, M. Z., & Goyal, V. K. (2009). Capital structure decisions: which factors are reliably important? Financial Management, 38(1), 1–37. https://doi.org/10.1111/j.1755-053X.2009.01026.x.

Gaud, P., Jani, E., Hoesli, M., & Bender, A. (2005). The capital structure of Swiss companies: an empirical analysis using dynamic panel data. European Financial Management, 11(1), 51–69. https://doi.org/10.1111/j.1354-7798.2005.00275.x.

Graham, J. R., & Harvey, C. R. (2001). The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics, 60(2–3), 187–243. https://doi.org/10.1016/S0304-405X(01)00044-7.

Green, R. C. (1984). Investment incentives, debt, and warrants. Journal of Financial Economics, 13(1), 115–136. https://doi.org/10.1016/0304-405X(84)90034-5.

Harris, M., & Raviv, A. (1990). Capital structure and the informational role of debt. The Journal of Finance, 45(2), 321–349. https://doi.org/10.1111/j.1540-6261.1990.tb03693.x.

Harris, M., & Raviv, A. (1991). The theory of capital structure. The Journal of Finance, 46(1), 297–355. https://doi.org/10.1111/j.1540-6261.1991.tb03753.x.

Harrison, B., & Widjaja, T. W. (2014). The determinants of capital structure: Comparison between before and after financial crisis. Economic Issues, 19(2), 55-82. Retrieved from https://pdfs.semanticscholar.org/ba15/07881d7c840d2a54c4ce6a6cd44aeab86f00.pdf.

Hillier, D., Grinblatt, M., & Titman, S. (2011). Financial markets and corporate strategy.

Hirshleifer, J. (1966). Investment decision under uncertainty: Applications of the state-preference approach. The Quarterly Journal of Economics, 80(2), 252–277. https://doi.org/10.2307/1880692.

https://doi.org/

Huang, R., & Ritter, J. R. (2009). Testing theories of capital structure and estimating the speed of adjustment. Journal of Financial and Quantitative Analysis, 44(2), 237–271.

Hung, N. M. (2007). Real estate market: current situation and solutions. Retrieved from https://nctu.edu.vn/uploads/page/2016_01/bai-nghien-cuu-bat-dong-san-02-tien-sy-Hung.pdf.

Chakeri, S. N., Eslami, M. & Kalantar, M. (2018). Evaluation and Analysis of Monitoring of Productivity of Greenhouse Cucumber in Yazd Province. International Journal of Pharmaceutical Research & Allied Sciences, 7(2), 160-167.

Chakraborty, I. (2010). Capital structure in an emerging stock market: The case of India. Research in International Business and Finance, 24(3), 295–314. https://doi.org/10.1016/j.ribaf.2010.02.001.

Chen, J., & Strange, R. (2005). The determinants of capital structure: Evidence from Chinese listed companies. Economic Change and Restructuring, 38(1), 11–35. https://doi.org/10.1007/s10644-005-4521-7.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review, 76(2), 323–329. Retrieved from www.jstor.org/stable/1818789.

Jensen, M. C., & Meckling, W. H. (1979). Theory of the firm: Managerial behavior, agency costs, and ownership structure. In Economics social institutions (pp. 163-231). Springer, Dordrecht. https://doi.org/10.1007/978-94-009-9257-3_8.

Keshvarz, L., Farahani, A. & Saldehi, M. H. S. (2017). Organizational Intangible Assets (human, social and psychological capitals) and Corporate Entrepreneurship-Case Study: Ministry of Sport and Youth of Islamic Republic of Iran. International Journal of Pharmaceutical Research & Allied Sciences, 6(3), 79-92.

Lang, L., Ofek, E., & Stulz, R. (1996). Leverage, investment, and firm growth. Journal of Financial Economics, 40(1), 3–29. https://doi.org/10.1016/0304-405X(95)00842-3.

mac an Bhaird, C., & Lucey, B. (2010). Determinants of capital structure in Irish SMEs. Small Business Economics, 35(3), 357–375. https://doi.org/10.1007/s11187-008-9162-6.

Miguel, A., & Pindado, J. (2001). Determinants of Capital Structure: New Evidence from Spanish Panel Data. Journal of Corporate Finance, 7, 77–99. https://doi.org/10.1016/S0929-1199(00)00020-1.

Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance, and the theory of investment. The American Economic Review, 48(3), 261–297. Retrieved from www.jstor.org/stable/1809766.

Myers, S. C. (1977). Determinants of corporate borrowing. Journal of Financial Economics, 5(2), 147–175. https://doi.org/10.1016/0304-405X(77)90015-0.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have (No. w1396). National Bureau of Economic Research. https://doi.org/10.3386/w1396.

Myers, S. C., & Rajan, R. G. (1998). The Paradox Of Liquidity. The Quarterly Journal of Economics, 113, 733–771. https://doi.org/10.1162/003355398555739.

Nachane, D. M. (2006). Econometrics: Theoretical Foundations and Empirical Perspectives. Number 9780195647907 in OUP Catalogue. Oxford University Press. Retrieved from https://ideas.repec.org/b/oxp/obooks/9780195647907.html.

Novaland. (2014). 30 thousand VND pack: easier in new lending conditions. In Novaland Group. Retrieved from https://www.novaland.com.vn/News/NewsDetail.aspx?zoneid=113&NewsID=1394.

Ooghe, H., Heyman, D., & Deloof, M. (2008). The Financial Structure of Private Held Belgian Firms. Small Business Economics, 30, 301–313. https://doi.org/10.1007/s11187-006-9031-0.

Ozkan, A. (2001). Determinants of capital structure and adjustment to long-run target: evidence from UK company panel data. Journal of Business Finance & Accounting, 28(1–2), 175–198. https://doi.org/10.1111/1468-5957.00370.

Pathak, J. (2010). What Determines Capital Structure of Listed Firms in India?: Some Empirical Evidences from The Indian Capital Market. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1561145.

Petersen, M. A., & Rajan, R. G. (1994). The benefits of lending relationships: Evidence from small business data. The Journal of Finance, 49(1), 3–37. https://doi.org/10.1111/j.1540-6261.1994.tb04418.x.

Proença, P., Laureano, R., & Laureano, L. (2014). Determinants of Capital Structure and the 2008 Financial Crisis: Evidence from Portuguese SMEs. Procedia - Social and Behavioral Sciences, 150, 182–191. https://doi.org/10.1016/j.sbspro.2014.09.027.

Rajan, R. G., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. The Journal of Finance, 50(5), 1421–1460. https://doi.org/10.1111/j.1540-6261.1995.tb05184.x

Ross, S. A. (1977). The determination of financial structure: the incentive-signaling approach. The Bell Journal of Economics, 23–40. https://doi.org/10.2307/3003485.

Shyam-Sunder, L., & Myers, S. C. (1999). Testing static tradeoff against pecking order models of capital structure. Journal of Financial Economics, 51(2), 219–244. https://doi.org/10.1016/S0304-405X(98)00051-8.

Son, T. H. (2008). Capital structure and firms’ performance. Banking Technology Review, 33, 21–35. Retrieved from http://www.vjol.info.vn/index.php/NH/article/view/13508/12357.

Titman, S. (1984). The effect of capital structure on a firm’s liquidation decision. Journal of Financial Economics, 13(1), 137–151. https://doi.org/10.1016/0304-405X(84)90035-7.

Titman, S., & Wessels, R. (1988). The determinants of capital structure choice. The Journal of Finance, 43(1), 1–19. https://doi.org/10.1111/j.1540-6261.1988.tb02585.x.

Tsyplakov, S. (2008). Investment frictions and leverage dynamics. Journal of Financial Economics, 89(3), 423–443. https://doi.org/10.1016/j.jfineco.2007.09.004.

Verbeek, M. (2008). A guide to modern econometrics. John Wiley & Sons.

Vinh, N. T. Q. (2015). Construction industry report. Retrieved from http://fpts.com.vn/FileStore2/File/2015/05/13/FPTS_baocaonganhxaydung_052015.pdf.

Vinh, V. X. (2017). Determinants of capital structure in emerging markets: Evidence from Vietnam. Research in International Business and Finance, 40, 105–113. https://doi.org/10.1016/j.ribaf.2016.12.001.

Zarei, G., Lalisarabi, A. & Jahandideh Topraghlou, M. (2019) Impact of relationship marketing on performance of pharmacies (the mediating role of satisfaction, loyalty and competitive advantage). Journal of Advanced Pharmacy Education & Research, 9(S2), 55-62.

Zeitun, R., & Tian, G. (2008). The determinants of capital structure: The case of longterm debt constraint for Jordanian firms. Corporate Ownership and Control, 6(1), 22–37.

Baltagi, B. (2008). Econometric analysis of panel data. John Wiley & Sons.

Barclay, M. J., Smith Jr, C. W., & Morellec, E. (2006). On the debt capacity of growth options. The Journal of Business, 79(1), 37–60. https://doi.org/10.1086/497404.

Baxter, N. D. (1967). Leverage, risk of ruin, and the cost of capital. The Journal of Finance, 22(3), 395–403. https://doi.org/10.2307/2978892.

Berger, A. N., & Udell, G. F. (1998). The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. Journal of Banking & Finance, 22(6–8), 613–673. https://doi.org/10.1016/S0378-4266(98)00038-7.

Berger, A. N., & Udell, G. F. (2002). Small business credit availability and relationship lending: The importance of bank organizational structure. The Economic Journal, 112(477), F32--F53. https://doi.org/10.1111/1468-0297.00682.

Bevan, A. A., & Danbolt, J. (2002). Capital structure and its determinants in the UK-a decompositional analysis. Applied Financial Economics, 12(3), 159–170. https://doi.org/10.1080/09603100110090073.

Booth, L., Aivazian, V., Demirguc-Kunt, A., & Maksimovic, V. (2001). Capital structures in developing countries. The Journal of Finance, 56(1), 87–130. https://doi.org/10.1111/0022-1082.00320.

Boquist, J. A., & Moore, W. T. (1984). Inter-Industry Leverage Differences and the DeAngelo-Masulis Tax Shield Hypothesis. Financial Management, 13(1), 5–9. https://doi.org/10.2307/3665118.

Bowen, R. M., Daley, L. A., & Huber Jr, C. C. (1982). Evidence on the existence and determinants of inter-industry differences in leverage. Financial Management, 10–20. https://doi.org/10.2307/3665227.

Brigham, E. F., & Ehrhardt, M. C. (2013). Financial management: Theory & practice. Cengage Learning.

Copeland, T. E., Weston, J. F., Shastri, K., & others. (2005). Financial theory and corporate policy. Addison-Wesley Boston, MA.

Cortez, M. A., & Susanto, S. (2012). Testing theories of capital structure and estimating the speed of adjustment. Journal of International Business Research, 11(3), 121–134. https://doi.org/10.1017/S0022109009090152.

Deangelo, H., & Masulis, R. W. (1980). Optimal capital structure under corporate and personal taxation. Journal of Financial Economics, 8(1), 3–29. https://doi.org/10.1016/0304-405X(80)90019-7.

Djaddan, S., Ghozali, I., & others. (2017). The Role of Business Risk and Non-Debt Tax Shields to Debt to Equity Ratio on Pharmacy Listed Companies in Indonesia. International Journal of Economics and Financial Issues, 7(2), 73–80.

Esperanca, J. P., Gama, A. P. M., & Gulamhussen, M. A. (2003). Corporate debt policy of small firms: an empirical (re) examination. Journal of Small Business and Enterprise Development. https://doi.org/10.1108/14626000310461213.

Frank, M. Z., & Goyal, V. K. (2003). Testing the pecking order theory of capital structure. Journal of Financial Economics, 67(2), 217–248. https://doi.org/10.1016/S0304-405X(02)00252-0.

Frank, M. Z., & Goyal, V. K. (2005). Trade-off and pecking order theories of debt. The Handbook of Empirical Corporate Finance. Elsevier Science. https://doi.org/10.1016/B978-0-444-53265-7.50004-4.

Frank, M. Z., & Goyal, V. K. (2009). Capital structure decisions: which factors are reliably important? Financial Management, 38(1), 1–37. https://doi.org/10.1111/j.1755-053X.2009.01026.x.

Gaud, P., Jani, E., Hoesli, M., & Bender, A. (2005). The capital structure of Swiss companies: an empirical analysis using dynamic panel data. European Financial Management, 11(1), 51–69. https://doi.org/10.1111/j.1354-7798.2005.00275.x.

Graham, J. R., & Harvey, C. R. (2001). The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics, 60(2–3), 187–243. https://doi.org/10.1016/S0304-405X(01)00044-7.

Green, R. C. (1984). Investment incentives, debt, and warrants. Journal of Financial Economics, 13(1), 115–136. https://doi.org/10.1016/0304-405X(84)90034-5.

Harris, M., & Raviv, A. (1990). Capital structure and the informational role of debt. The Journal of Finance, 45(2), 321–349. https://doi.org/10.1111/j.1540-6261.1990.tb03693.x.

Harris, M., & Raviv, A. (1991). The theory of capital structure. The Journal of Finance, 46(1), 297–355. https://doi.org/10.1111/j.1540-6261.1991.tb03753.x.

Harrison, B., & Widjaja, T. W. (2014). The determinants of capital structure: Comparison between before and after financial crisis. Economic Issues, 19(2), 55-82. Retrieved from https://pdfs.semanticscholar.org/ba15/07881d7c840d2a54c4ce6a6cd44aeab86f00.pdf.

Hillier, D., Grinblatt, M., & Titman, S. (2011). Financial markets and corporate strategy.

Hirshleifer, J. (1966). Investment decision under uncertainty: Applications of the state-preference approach. The Quarterly Journal of Economics, 80(2), 252–277. https://doi.org/10.2307/1880692.

https://doi.org/

Huang, R., & Ritter, J. R. (2009). Testing theories of capital structure and estimating the speed of adjustment. Journal of Financial and Quantitative Analysis, 44(2), 237–271.

Hung, N. M. (2007). Real estate market: current situation and solutions. Retrieved from https://nctu.edu.vn/uploads/page/2016_01/bai-nghien-cuu-bat-dong-san-02-tien-sy-Hung.pdf.

Chakeri, S. N., Eslami, M. & Kalantar, M. (2018). Evaluation and Analysis of Monitoring of Productivity of Greenhouse Cucumber in Yazd Province. International Journal of Pharmaceutical Research & Allied Sciences, 7(2), 160-167.

Chakraborty, I. (2010). Capital structure in an emerging stock market: The case of India. Research in International Business and Finance, 24(3), 295–314. https://doi.org/10.1016/j.ribaf.2010.02.001.

Chen, J., & Strange, R. (2005). The determinants of capital structure: Evidence from Chinese listed companies. Economic Change and Restructuring, 38(1), 11–35. https://doi.org/10.1007/s10644-005-4521-7.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review, 76(2), 323–329. Retrieved from www.jstor.org/stable/1818789.

Jensen, M. C., & Meckling, W. H. (1979). Theory of the firm: Managerial behavior, agency costs, and ownership structure. In Economics social institutions (pp. 163-231). Springer, Dordrecht. https://doi.org/10.1007/978-94-009-9257-3_8.

Keshvarz, L., Farahani, A. & Saldehi, M. H. S. (2017). Organizational Intangible Assets (human, social and psychological capitals) and Corporate Entrepreneurship-Case Study: Ministry of Sport and Youth of Islamic Republic of Iran. International Journal of Pharmaceutical Research & Allied Sciences, 6(3), 79-92.

Lang, L., Ofek, E., & Stulz, R. (1996). Leverage, investment, and firm growth. Journal of Financial Economics, 40(1), 3–29. https://doi.org/10.1016/0304-405X(95)00842-3.

mac an Bhaird, C., & Lucey, B. (2010). Determinants of capital structure in Irish SMEs. Small Business Economics, 35(3), 357–375. https://doi.org/10.1007/s11187-008-9162-6.

Miguel, A., & Pindado, J. (2001). Determinants of Capital Structure: New Evidence from Spanish Panel Data. Journal of Corporate Finance, 7, 77–99. https://doi.org/10.1016/S0929-1199(00)00020-1.

Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance, and the theory of investment. The American Economic Review, 48(3), 261–297. Retrieved from www.jstor.org/stable/1809766.

Myers, S. C. (1977). Determinants of corporate borrowing. Journal of Financial Economics, 5(2), 147–175. https://doi.org/10.1016/0304-405X(77)90015-0.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have (No. w1396). National Bureau of Economic Research. https://doi.org/10.3386/w1396.

Myers, S. C., & Rajan, R. G. (1998). The Paradox Of Liquidity. The Quarterly Journal of Economics, 113, 733–771. https://doi.org/10.1162/003355398555739.

Nachane, D. M. (2006). Econometrics: Theoretical Foundations and Empirical Perspectives. Number 9780195647907 in OUP Catalogue. Oxford University Press. Retrieved from https://ideas.repec.org/b/oxp/obooks/9780195647907.html.

Novaland. (2014). 30 thousand VND pack: easier in new lending conditions. In Novaland Group. Retrieved from https://www.novaland.com.vn/News/NewsDetail.aspx?zoneid=113&NewsID=1394.

Ooghe, H., Heyman, D., & Deloof, M. (2008). The Financial Structure of Private Held Belgian Firms. Small Business Economics, 30, 301–313. https://doi.org/10.1007/s11187-006-9031-0.

Ozkan, A. (2001). Determinants of capital structure and adjustment to long-run target: evidence from UK company panel data. Journal of Business Finance & Accounting, 28(1–2), 175–198. https://doi.org/10.1111/1468-5957.00370.

Pathak, J. (2010). What Determines Capital Structure of Listed Firms in India?: Some Empirical Evidences from The Indian Capital Market. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1561145.

Petersen, M. A., & Rajan, R. G. (1994). The benefits of lending relationships: Evidence from small business data. The Journal of Finance, 49(1), 3–37. https://doi.org/10.1111/j.1540-6261.1994.tb04418.x.